options(repr.plot.width = 12, repr.plot.height = 6)Ch08 ARIMA 모형의 적합

EX 8.6 가스공급비율

z <- scan("gas.txt", what=list(0,0))head(z)-

- -0.109

- 0

- 0.178

- 0.339

- 0.373

- 0.441

- 0.461

- 0.348

- 0.127

- -0.18

- -0.588

- -1.055

- -1.421

- -1.52

- -1.302

- -0.814

- -0.475

- -0.193

- 0.088

- 0.435

- 0.771

- 0.866

- 0.875

- 0.891

- 0.987

- 1.263

- 1.775

- 1.976

- 1.934

- 1.866

- 1.832

- 1.767

- 1.608

- 1.265

- 0.79

- 0.36

- 0.115

- 0.088

- 0.331

- 0.645

- 0.96

- 1.409

- 2.67

- 2.834

- 2.812

- 2.483

- 1.929

- 1.485

- 1.214

- 1.239

- 1.608

- 1.905

- 2.023

- 1.815

- 0.535

- 0.122

- 0.009

- 0.164

- 0.671

- 1.019

- 1.146

- 1.155

- 1.112

- 1.121

- 1.223

- 1.257

- 1.157

- 0.913

- 0.62

- 0.255

- -0.28

- -1.08

- -1.551

- -1.799

- -1.825

- -1.456

- -0.944

- -0.57

- -0.431

- -0.577

- -0.96

- -1.616

- -1.875

- -1.891

- -1.746

- -1.474

- -1.201

- -0.927

- -0.524

- 0.04

- 0.788

- 0.943

- 0.93

- 1.006

- 1.137

- 1.198

- 1.054

- 0.595

- -0.08

- -0.314

- -0.288

- -0.153

- -0.109

- -0.187

- -0.255

- -0.229

- -0.007

- 0.254

- 0.33

- 0.102

- -0.423

- -1.139

- -2.275

- -2.594

- -2.716

- -2.51

- -1.79

- -1.346

- -1.081

- -0.91

- -0.876

- -0.885

- -0.8

- -0.544

- -0.416

- -0.271

- 0

- 0.403

- 0.841

- 1.285

- 1.607

- 1.746

- 1.683

- 1.485

- 0.993

- 0.648

- 0.577

- 0.577

- 0.632

- 0.747

- 0.9

- 0.993

- 0.968

- 0.79

- 0.399

- -0.161

- -0.553

- -0.603

- -0.424

- -0.194

- -0.049

- 0.06

- 0.161

- 0.301

- 0.517

- 0.566

- 0.56

- 0.573

- 0.592

- 0.671

- 0.933

- 1.337

- 1.46

- 1.353

- 0.772

- 0.218

- -0.237

- -0.714

- -1.099

- -1.269

- -1.175

- -0.676

- 0.033

- 0.556

- 0.643

- 0.484

- 0.109

- -0.31

- -0.697

- -1.047

- -1.218

- -1.183

- -0.873

- -0.336

- 0.063

- 0.084

- 0

- 0.001

- 0.209

- 0.556

- 0.782

- 0.858

- 0.918

- 0.862

- 0.416

- -0.336

- -0.959

- -1.813

- -2.378

- -2.499

- -2.473

- -2.33

- -2.053

- -1.739

- -1.261

- -0.569

- -0.137

- -0.024

- -0.05

- -0.135

- -0.276

- -0.534

- -0.871

- -1.243

- -1.439

- -1.422

- -1.175

- -0.813

- -0.634

- -0.582

- -0.625

- -0.713

- -0.848

- -1.039

- -1.346

- -1.628

- -1.619

- -1.149

- -0.488

- -0.16

- -0.007

- -0.092

- -0.62

- -1.086

- -1.525

- -1.858

- -2.029

- -2.024

- -1.961

- -1.952

- -1.794

- -1.302

- -1.03

- -0.918

- -0.798

- -0.867

- -1.047

- -1.123

- -0.876

- -0.395

- 0.185

- 0.662

- 0.709

- 0.605

- 0.501

- 0.603

- 0.943

- 1.223

- 1.249

- 0.824

- 0.102

- 0.025

- 0.382

- 0.922

- 1.032

- 0.866

- 0.527

- 0.093

- -0.458

- -0.748

- -0.947

- -1.029

- -0.928

- -0.645

- -0.424

- -0.276

- -0.158

- -0.033

- 0.102

- 0.251

- 0.28

- 0

- -0.493

- -0.759

- -0.824

- -0.74

- -0.528

- -0.204

- 0.034

- 0.204

- 0.253

- 0.195

- 0.131

- 0.017

- -0.182

- -0.262

-

- 53.8

- 53.6

- 53.5

- 53.5

- 53.4

- 53.1

- 52.7

- 52.4

- 52.2

- 52

- 52

- 52.4

- 53

- 54

- 54.9

- 56

- 56.8

- 56.8

- 56.4

- 55.7

- 55

- 54.3

- 53.2

- 52.3

- 51.6

- 51.2

- 50.8

- 50.5

- 50

- 49.2

- 48.4

- 47.9

- 47.6

- 47.5

- 47.5

- 47.6

- 48.1

- 49

- 50

- 51.1

- 51.8

- 51.9

- 51.7

- 51.2

- 50

- 48.3

- 47

- 45.8

- 45.6

- 46

- 46.9

- 47.8

- 48.2

- 48.3

- 47.9

- 47.2

- 47.2

- 48.1

- 49.4

- 50.6

- 51.5

- 51.6

- 51.2

- 50.5

- 50.1

- 49.8

- 49.6

- 49.4

- 49.3

- 49.2

- 49.3

- 49.7

- 50.3

- 51.3

- 52.8

- 54.4

- 56

- 56.9

- 57.5

- 57.3

- 56.6

- 56

- 55.4

- 55.4

- 56.4

- 57.2

- 58

- 58.4

- 58.4

- 58.1

- 57.7

- 57

- 56

- 54.7

- 53.2

- 52.1

- 51.6

- 51

- 50.5

- 50.4

- 51

- 51.8

- 52.4

- 53

- 53.4

- 53.6

- 53.7

- 53.8

- 53.8

- 53.8

- 53.3

- 53

- 52.9

- 53.4

- 54.6

- 56.4

- 58

- 59.4

- 60.2

- 60

- 59.4

- 58.4

- 57.6

- 56.9

- 56.4

- 56

- 55.7

- 55.3

- 55

- 54.4

- 53.7

- 52.8

- 51.6

- 50.6

- 49.4

- 48.8

- 48.5

- 48.7

- 49.2

- 49.8

- 50.4

- 50.7

- 50.9

- 50.7

- 50.5

- 50.4

- 50.2

- 50.4

- 51.2

- 52.3

- 53.2

- 53.9

- 54.1

- 54

- 53.6

- 53.2

- 53

- 52.8

- 52.3

- 51.9

- 51.6

- 51.6

- 51.4

- 51.2

- 50.7

- 50

- 49.4

- 49.3

- 49.7

- 50.6

- 51.8

- 53

- 54

- 55.3

- 55.9

- 55.9

- 54.6

- 53.5

- 52.4

- 52.1

- 52.3

- 53

- 53.8

- 54.6

- 55.4

- 55.9

- 55.9

- 55.2

- 54.4

- 53.7

- 53.6

- 53.6

- 53.2

- 52.5

- 52

- 51.4

- 51

- 50.9

- 52.4

- 53.5

- 55.6

- 58

- 59.5

- 60

- 60.4

- 60.5

- 60.2

- 59.7

- 59

- 57.6

- 56.4

- 55.2

- 54.5

- 54.1

- 54.1

- 54.4

- 55.5

- 56.2

- 57

- 57.3

- 57.4

- 57

- 56.4

- 55.9

- 55.5

- 55.3

- 55.2

- 55.4

- 56

- 56.5

- 57.1

- 57.3

- 56.8

- 55.6

- 55

- 54.1

- 54.3

- 55.3

- 56.4

- 57.2

- 57.8

- 58.3

- 58.6

- 58.8

- 58.8

- 58.6

- 58

- 57.4

- 57

- 56.4

- 56.3

- 56.4

- 56.4

- 56

- 55.2

- 54

- 53

- 52

- 51.6

- 51.6

- 51.1

- 50.4

- 50

- 50

- 52

- 54

- 55.1

- 54.5

- 52.8

- 51.4

- 50.8

- 51.2

- 52

- 52.8

- 53.8

- 54.5

- 54.9

- 54.9

- 54.8

- 54.4

- 53.7

- 53.3

- 52.8

- 52.6

- 52.6

- 53

- 54.3

- 56

- 57

- 58

- 58.6

- 58.5

- 58.3

- 57.8

- 57.3

- 57

1번째는 가스 2번째는 이산화탄소

dt <- data.frame( t = 1:length(z[[1]]),

rate = z[[1]],

co2 = z[[2]])

head(dt)| t | rate | co2 | |

|---|---|---|---|

| <int> | <dbl> | <dbl> | |

| 1 | 1 | -0.109 | 53.8 |

| 2 | 2 | 0.000 | 53.6 |

| 3 | 3 | 0.178 | 53.5 |

| 4 | 4 | 0.339 | 53.5 |

| 5 | 5 | 0.373 | 53.4 |

| 6 | 6 | 0.441 | 53.1 |

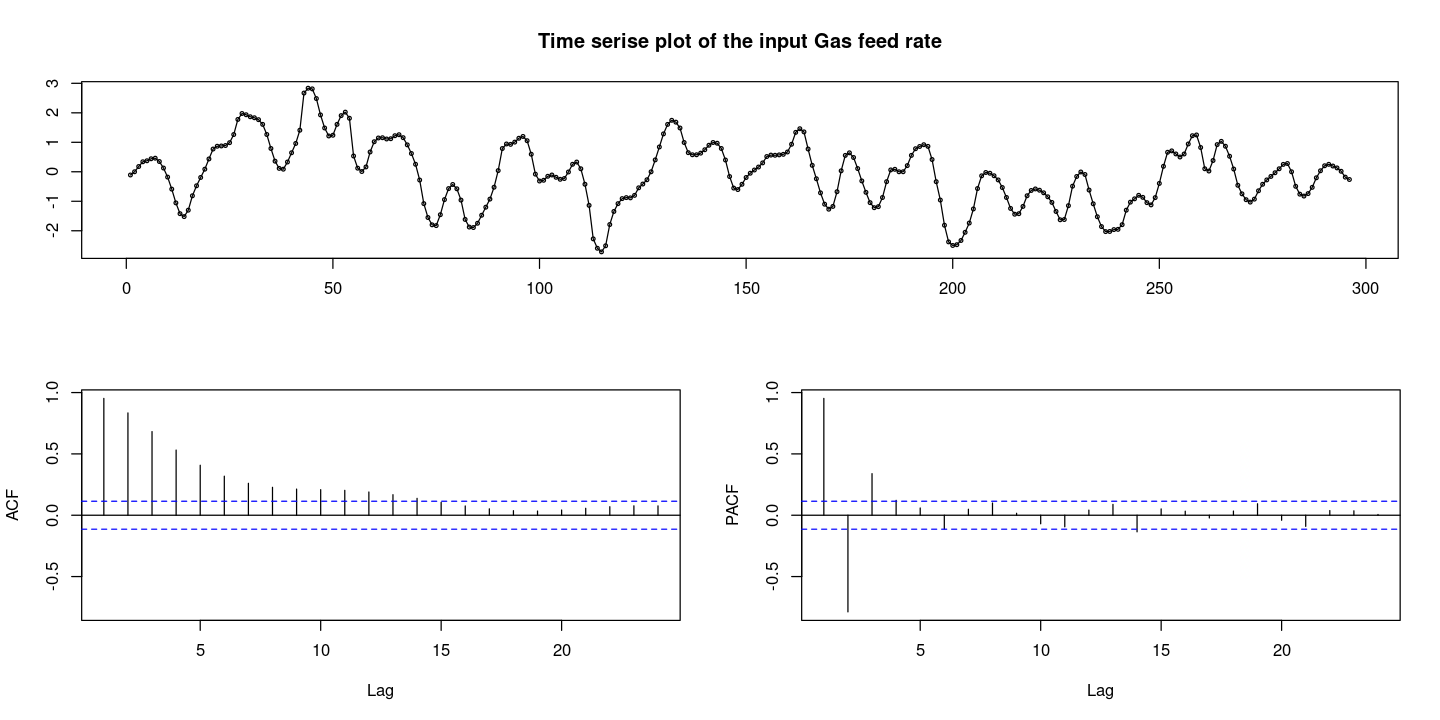

- 시도표와 ACF/PACF 그림 그리기

forecast::tsdisplay(dt$rate,

main = 'Time serise plot of the input Gas feed rate',

lag.max=24)Registered S3 method overwritten by 'quantmod':

method from

as.zoo.data.frame zoo

0을 기준으로 대칭인 것 처럼 보이고 등분산도 만족해 보인다. —> 정상시계열 같다.

결정적 추세는 없다.

ACF를 보면 확률적 추세가 있다면 천천히 감소하지만, 이건 지수적으로 감소하는 느낌이니까 확률적 추세가 있다고 하기엔 애매한 그림이다. 좀이따가 단위근 검정을 해보자.

PACF를 보면 3개만 살아있고 다 절단이다.

AR(3)모형이 적합해 보인다.

#모형 적합도 검정 : H0 : rho1=...=rho_k=0 : 포투맨트검정 : rate 가 백색잡음 과정인가?

Box.test(dt$rate, lag=1, type = "Ljung-Box")

Box.test(dt$rate, lag=6, type = "Ljung-Box") #rho1=rho2=...=rho6=0

Box.test(dt$rate, lag=12, type = "Ljung-Box") #rho1=...=rho12=0

Box-Ljung test

data: dt$rate

X-squared = 271.26, df = 1, p-value < 2.2e-16

Box-Ljung test

data: dt$rate

X-squared = 786.35, df = 6, p-value < 2.2e-16

Box-Ljung test

data: dt$rate

X-squared = 874.07, df = 12, p-value < 2.2e-16H0를 기각하지 못하면 WN이다.

H0를 기각하면 WH가 아니니가 모형 적합을 해야한다.

H0를 다 기각함. 모두 다 0인건 아님. WN아니야!

- 단위근 검정

### random walk process 에서의 단위근 검정

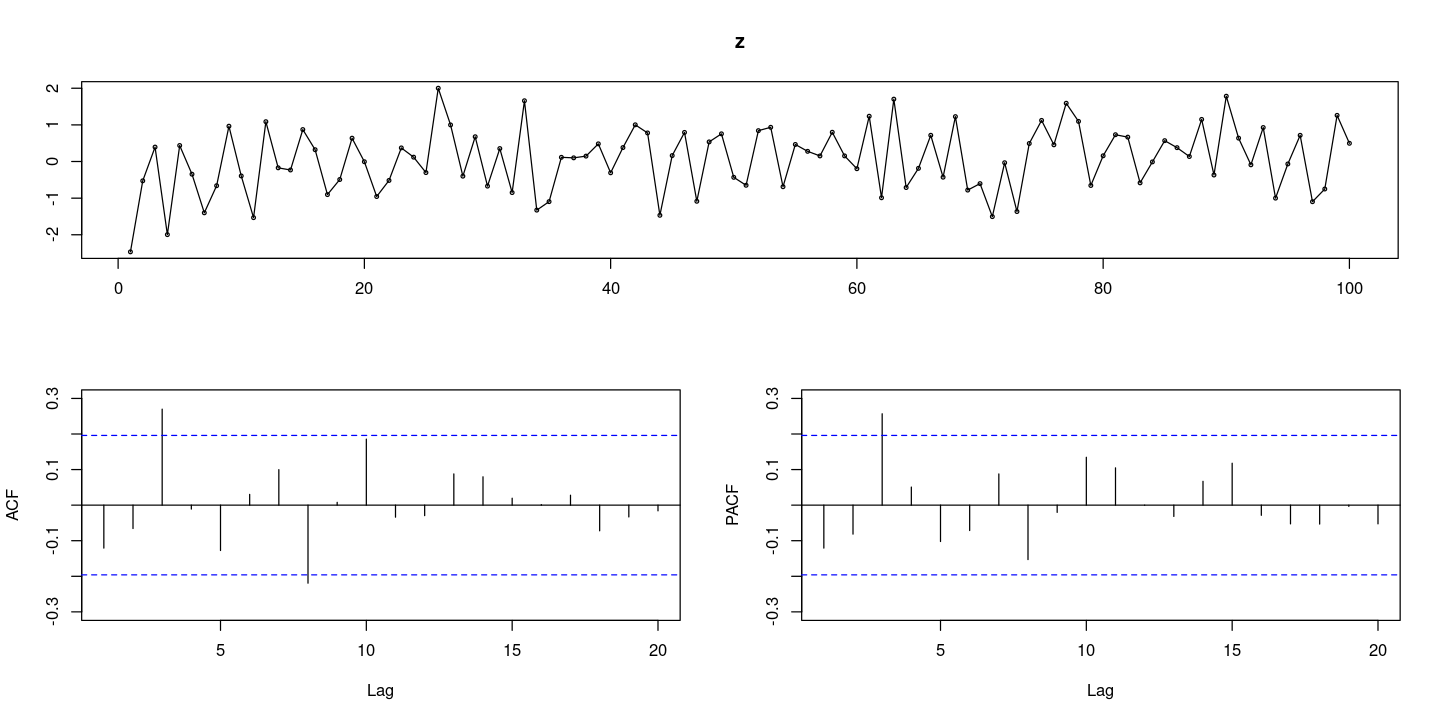

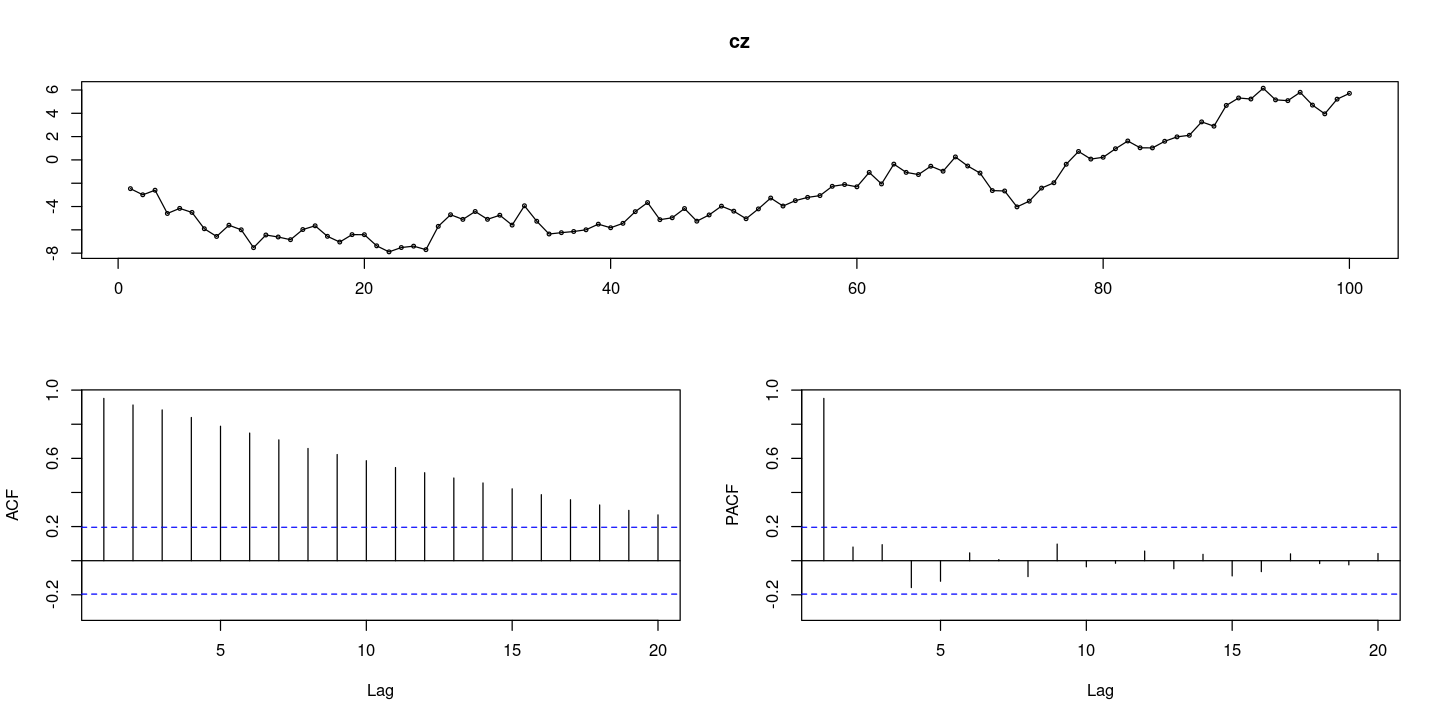

z <- rnorm(100) #WN

cz <- cumsum(z) #random walkforecast::tsdisplay(z)

forecast::tsdisplay(cz)

- ACF그래프가 천천히 감소한다.

fUnitRoots::adfTest(z, lags = 1, type = "nc")

#H0 : phi=1 단위근이 있다 , 차분이 필요하다. :(1-phi*B)Zt = et

#H1 : |rho|<1 단위근이 없다. 차분이 필요하지 않다.Warning message in fUnitRoots::adfTest(z, lags = 1, type = "nc"):

“p-value smaller than printed p-value”

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -8.2198

P VALUE:

0.01

Description:

Tue Nov 28 22:16:00 2023 by user: lags = 1 : 단위근이 1개 있는 거 보자

type: ‘nc’, ‘c’, ‘ct’ 3개가 있음

type = ‘nc’ : 가지고 있는 데이터가 평균이 0이면 이 옵션 사용

type = ‘c’ : 가지고 있는 데이터가 평균이 0이 아니면 이 옵션 사용 (상수항이 있는)

type = ‘ct’ : 결정적 추세가 있어 보이면 이 옵션 사용 (ㅅ상수항과 기울기가 있는)

WN이니까 차분이 필요하면 안되겠지? —> pvalue값이 작아. 기각 ㄱㄱ

fUnitRoots::adfTest(cz, lags = 0, type = "nc") #H0 : phi=1

fUnitRoots::adfTest(cz, lags = 1, type = "nc") #H0 : phi=1

fUnitRoots::adfTest(cz, lags = 2, type = "nc") #H0 : phi=1

#H0 : phi=1 단위근이 있다 , 차분이 필요하다. :(1-phi*B)Zt = et

#H1 : |rho|<1 단위근이 없다. 차분이 필요하지 않다.

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 0

STATISTIC:

Dickey-Fuller: -0.5717

P VALUE:

0.4309

Description:

Tue Nov 28 22:19:33 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -0.4404

P VALUE:

0.4728

Description:

Tue Nov 28 22:19:33 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 2

STATISTIC:

Dickey-Fuller: -0.3474

P VALUE:

0.5024

Description:

Tue Nov 28 22:19:33 2023 by user: - pvalue가 애매하게 되었따. 0.05로 주면 기각할 수 있지만 0.01이면 기각 못함..

## 단위근 검정 H0 : 단위근이 있다.

## 상수항, 추세 (nc, c, ct)

fUnitRoots::adfTest(dt$rate, lags = 1, type = "nc")Warning message in fUnitRoots::adfTest(dt$rate, lags = 1, type = "nc"):

“p-value smaller than printed p-value”

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -7.6608

P VALUE:

0.01

Description:

Tue Nov 28 22:21:39 2023 by user: - 기각을 해버리자 —> 단위근 없다 —> 차분 필요 없다.

- 평균 포함

## 평균 포함

mean(dt$rate)- 거의 0에 가깝다.

t.test(dt$rate) # H0 : mu=0

One Sample t-test

data: dt$rate

t = -0.91149, df = 295, p-value = 0.3628

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.17954799 0.06587907

sample estimates:

mean of x

-0.05683446 - pvalue가 0.3이 되서 H0를 기각 못한다. 즉 mu=0이다.

- arima

# ?arimainclude.mean = TRUE: default가 true이다.fixed= AR()모형으로 픽스할래 ! 이런식으로 할 때init= 초기값 설정

- 모형 적합 : AR(3)

## 모형 적합

fit1 <- arima(dt$rate, order=c(3,0,0)) #method = c("CSS-ML", "ML", "CSS")

#default method: to use CLSE to find starting values, then ML

fit1

# intercept = mu

Call:

arima(x = dt$rate, order = c(3, 0, 0))

Coefficients:

ar1 ar2 ar3 intercept

1.9691 -1.3651 0.3394 -0.0606

s.e. 0.0544 0.0985 0.0543 0.1898

sigma^2 estimated as 0.0353: log likelihood = 72.57, aic = -135.14summary(fit1)

Call:

arima(x = dt$rate, order = c(3, 0, 0))

Coefficients:

ar1 ar2 ar3 intercept

1.9691 -1.3651 0.3394 -0.0606

s.e. 0.0544 0.0985 0.0543 0.1898

sigma^2 estimated as 0.0353: log likelihood = 72.57, aic = -135.14

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set 3.004966e-05 0.1878719 0.1307624 NaN Inf 0.5140648 -0.03522643- 통계적 유의성 확인하려고 할 때: coeftest

lmtest::coeftest(fit1)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 1.969066 0.054385 36.2061 < 2.2e-16 ***

ar2 -1.365143 0.098538 -13.8540 < 2.2e-16 ***

ar3 0.339404 0.054328 6.2473 4.177e-10 ***

intercept -0.060643 0.189800 -0.3195 0.7493

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1- ph1, ph2, ph3는 다 유의하다. intercept(평균)은 별로 유이하지 않아.

fit2 <- arima(dt$rate, order=c(3,0,0), include.mean = F) # 위에서 평균은 유의하지 않았으므로 평균 빼고 다시 적합

summary(fit2)

Call:

arima(x = dt$rate, order = c(3, 0, 0), include.mean = F)

Coefficients:

ar1 ar2 ar3

1.9696 -1.3659 0.3399

s.e. 0.0544 0.0985 0.0543

sigma^2 estimated as 0.03531: log likelihood = 72.52, aic = -137.04

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set -0.003418121 0.1879034 0.1305995 NaN Inf 0.5134245 -0.03583041- AIC가 감소했으므로 mean을 뺀게 더 유의한 모형

lmtest::coeftest(fit2)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 1.969560 0.054371 36.2243 < 2.2e-16 ***

ar2 -1.365925 0.098522 -13.8641 < 2.2e-16 ***

ar3 0.339906 0.054314 6.2582 3.894e-10 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1ls(fit1)- 'aic'

- 'arma'

- 'call'

- 'code'

- 'coef'

- 'loglik'

- 'mask'

- 'model'

- 'n.cond'

- 'nobs'

- 'residuals'

- 'series'

- 'sigma2'

- 'var.coef'

fit1$aic

fit2$aicfit2$sigma2 # 오차의 분산에 대한 추정량- 잠정모형 : AR(3)

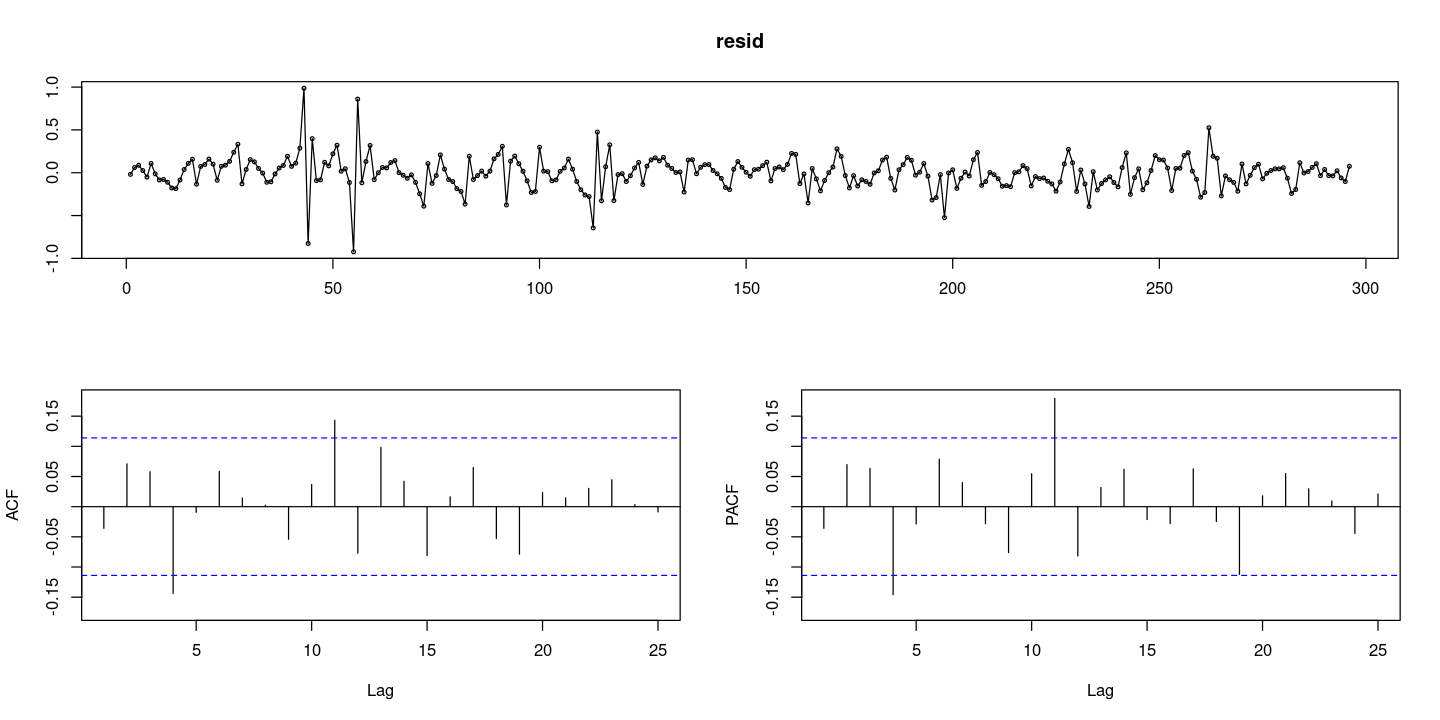

- 잔차분석

resid = resid(fit2)

forecast::tsdisplay(resid)

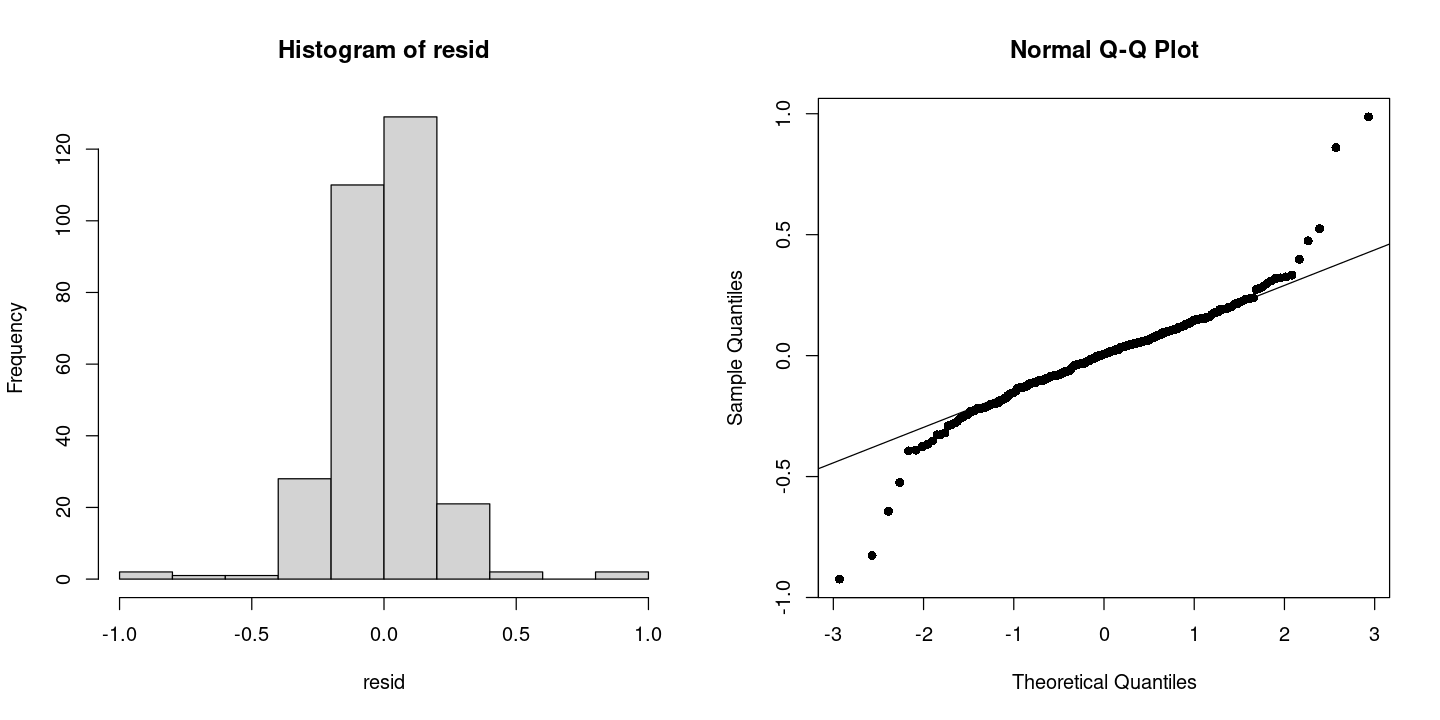

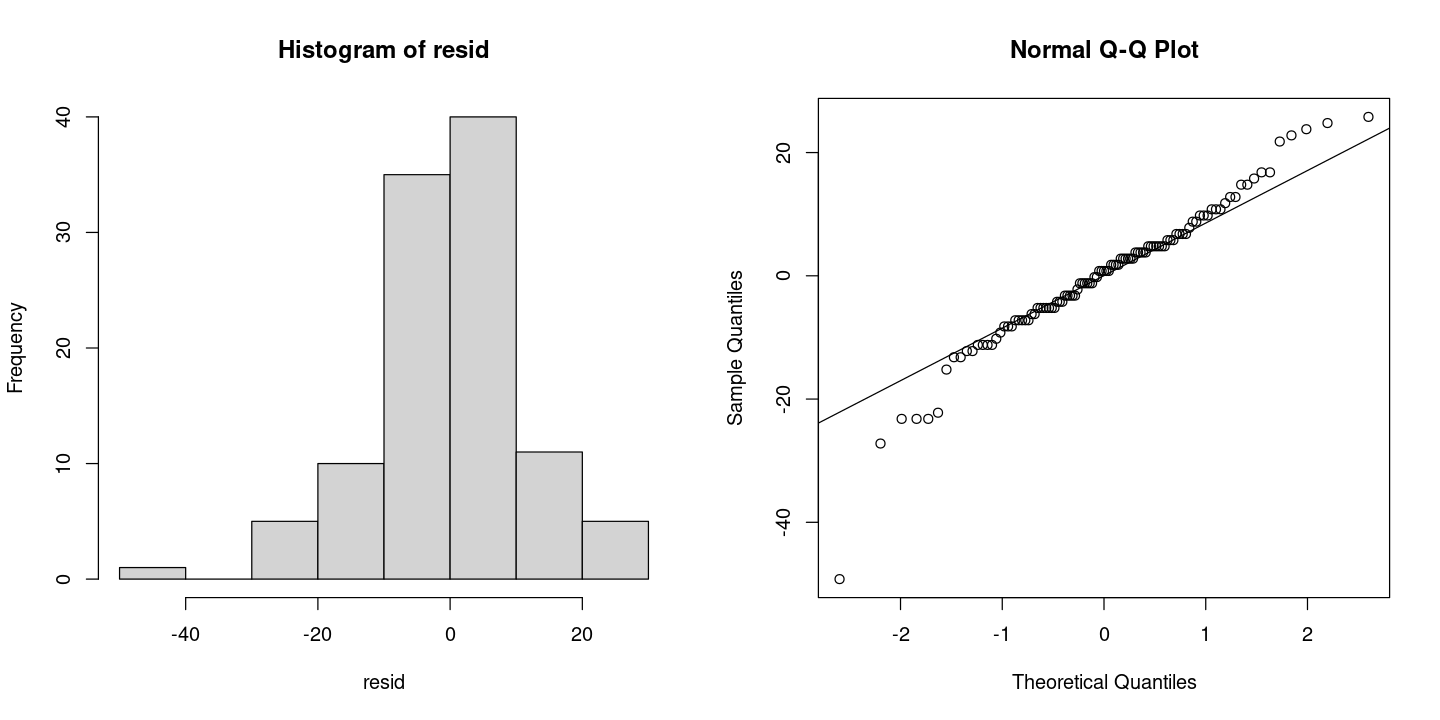

- 잔차의 정규성 검정

## 정규성검정

tseries::jarque.bera.test(resid) ##JB test H0: normal distribution

Jarque Bera Test

data: resid

X-squared = 496.68, df = 2, p-value < 2.2e-16par(mfrow=c(1,2))

hist(resid)

qqnorm(resid, pch=16)

qqline(resid)

- 꼬리가 엄청 두껍다. 정규분포 ㄴㄴ같은데? 근데 책에서는 몇개 튀어나온 5개 점 때문에 그런거니까 그거 빼곤 정규분포 같아~ 라구 하기도 한다.

# 잔차의 포트맨토 검정 ## H0 : rho1=...=rho_k=0

portes::LjungBox(fit2, lags=c(6,12,18,24))| lags | statistic | df | p-value | |

|---|---|---|---|---|

| 6 | 10.21058 | 3 | 0.01685835 | |

| 12 | 19.76879 | 9 | 0.01939412 | |

| 18 | 27.70650 | 15 | 0.02348012 | |

| 24 | 30.86553 | 21 | 0.07592519 |

6번째깢/ 12번째까지/ 18번쨰까지/ 24번쨰까지 싹 다 0인지 보여줘!

이상점 때문에 pvalue값이 애매하게 나옴

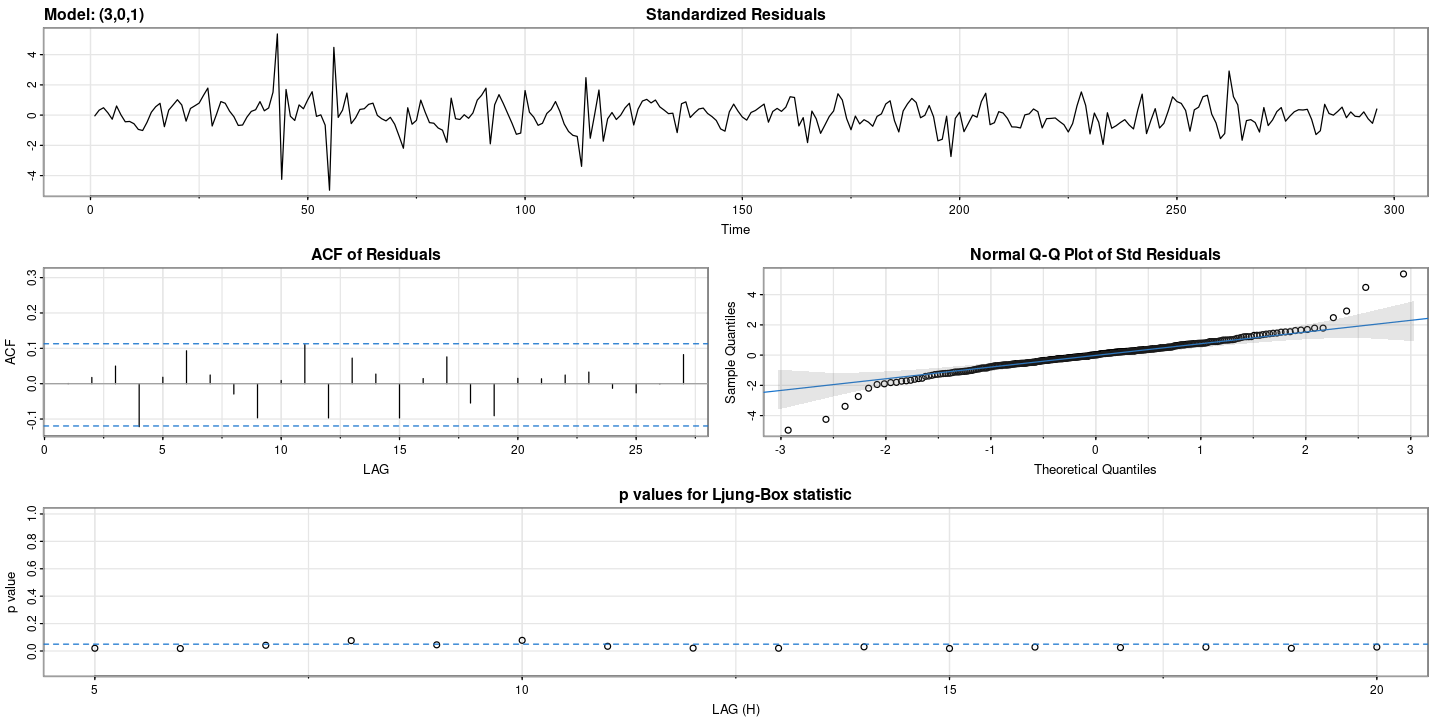

## 잔차 검정

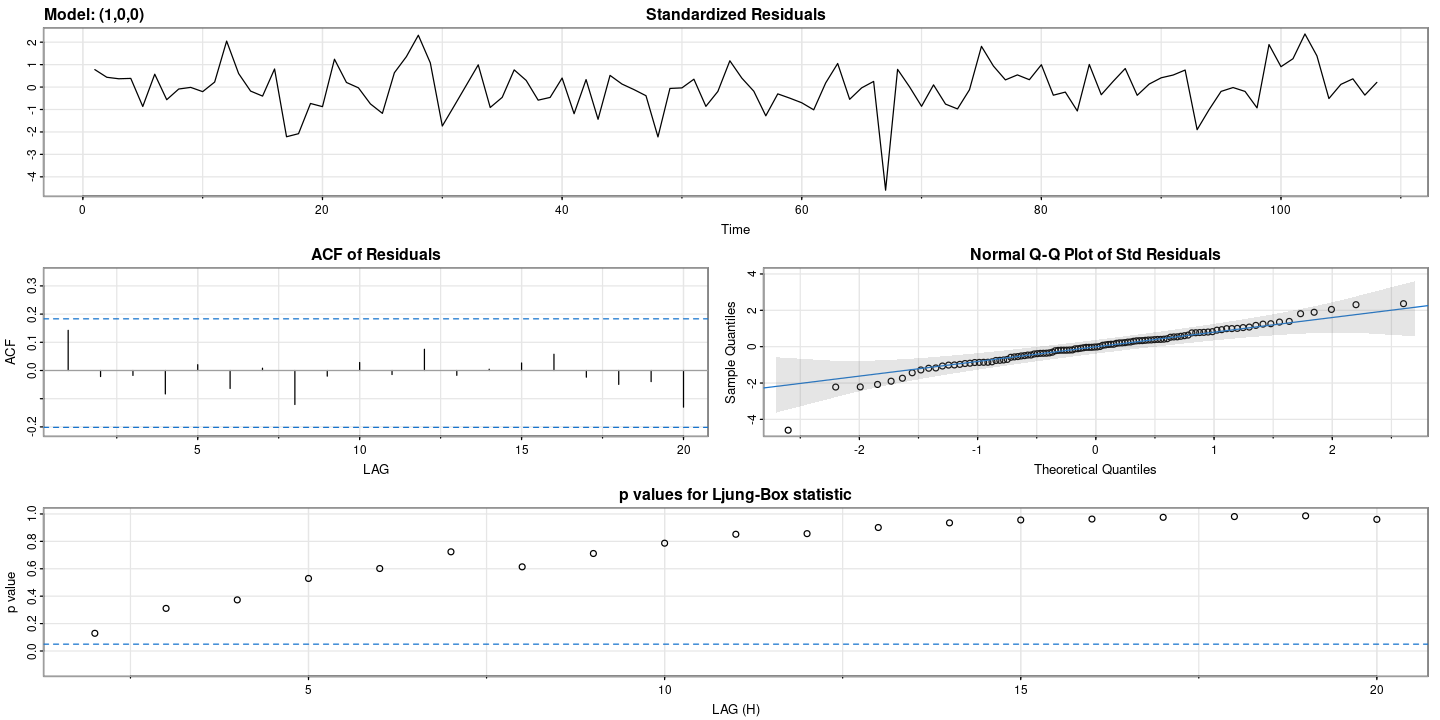

astsa::sarima(dt$rate, p=3, d=0, q=1)initial value 0.073551

iter 2 value -0.073322

iter 3 value -0.178255

iter 4 value -0.376823

iter 5 value -0.612419

iter 6 value -0.918313

iter 7 value -1.297243

iter 8 value -1.540430

iter 9 value -1.547244

iter 10 value -1.619914

iter 11 value -1.629287

iter 12 value -1.632509

iter 13 value -1.632906

iter 14 value -1.633608

iter 15 value -1.635745

iter 16 value -1.637069

iter 17 value -1.637183

iter 18 value -1.637941

iter 19 value -1.638469

iter 20 value -1.639157

iter 21 value -1.645795

iter 22 value -1.654637

iter 23 value -1.659278

iter 24 value -1.667888

iter 25 value -1.672991

iter 26 value -1.674756

iter 27 value -1.675067

iter 28 value -1.675120

iter 29 value -1.675335

iter 30 value -1.675343

iter 31 value -1.675347

iter 32 value -1.675363

iter 33 value -1.675371

iter 34 value -1.675374

iter 35 value -1.675374

iter 35 value -1.675374

iter 35 value -1.675374

final value -1.675374

converged

initial value -1.671802

iter 2 value -1.671805

iter 3 value -1.671828

iter 4 value -1.671829

iter 5 value -1.671833

iter 6 value -1.671834

iter 7 value -1.671837

iter 8 value -1.671837

iter 9 value -1.671838

iter 10 value -1.671838

iter 11 value -1.671838

iter 12 value -1.671839

iter 13 value -1.671839

iter 14 value -1.671839

iter 14 value -1.671839

iter 14 value -1.671839

final value -1.671839

converged$fit

Call:

arima(x = xdata, order = c(p, d, q), seasonal = list(order = c(P, D, Q), period = S),

xreg = xmean, include.mean = FALSE, transform.pars = trans, fixed = fixed,

optim.control = list(trace = trc, REPORT = 1, reltol = tol))

Coefficients:

ar1 ar2 ar3 ma1 xmean

2.2497 -1.8431 0.5607 -0.3203 -0.0593

s.e. 0.1158 0.1954 0.0909 0.1344 0.2202

sigma^2 estimated as 0.03475: log likelihood = 74.86, aic = -137.72

$degrees_of_freedom

[1] 291

$ttable

Estimate SE t.value p.value

ar1 2.2497 0.1158 19.4217 0.0000

ar2 -1.8431 0.1954 -9.4338 0.0000

ar3 0.5607 0.0909 6.1657 0.0000

ma1 -0.3203 0.1344 -2.3830 0.0178

xmean -0.0593 0.2202 -0.2694 0.7878

$AIC

[1] -0.4652596

$AICc

[1] -0.4645607

$BIC

[1] -0.390455

astsa::sarima(dt$rate, p=3, d=0, q=1, details=F)$fit

Call:

arima(x = xdata, order = c(p, d, q), seasonal = list(order = c(P, D, Q), period = S),

xreg = xmean, include.mean = FALSE, transform.pars = trans, fixed = fixed,

optim.control = list(trace = trc, REPORT = 1, reltol = tol))

Coefficients:

ar1 ar2 ar3 ma1 xmean

2.2497 -1.8431 0.5607 -0.3203 -0.0593

s.e. 0.1158 0.1954 0.0909 0.1344 0.2202

sigma^2 estimated as 0.03475: log likelihood = 74.86, aic = -137.72

$degrees_of_freedom

[1] 291

$ttable

Estimate SE t.value p.value

ar1 2.2497 0.1158 19.4217 0.0000

ar2 -1.8431 0.1954 -9.4338 0.0000

ar3 0.5607 0.0909 6.1657 0.0000

ma1 -0.3203 0.1344 -2.3830 0.0178

xmean -0.0593 0.2202 -0.2694 0.7878

$AIC

[1] -0.4652596

$AICc

[1] -0.4645607

$BIC

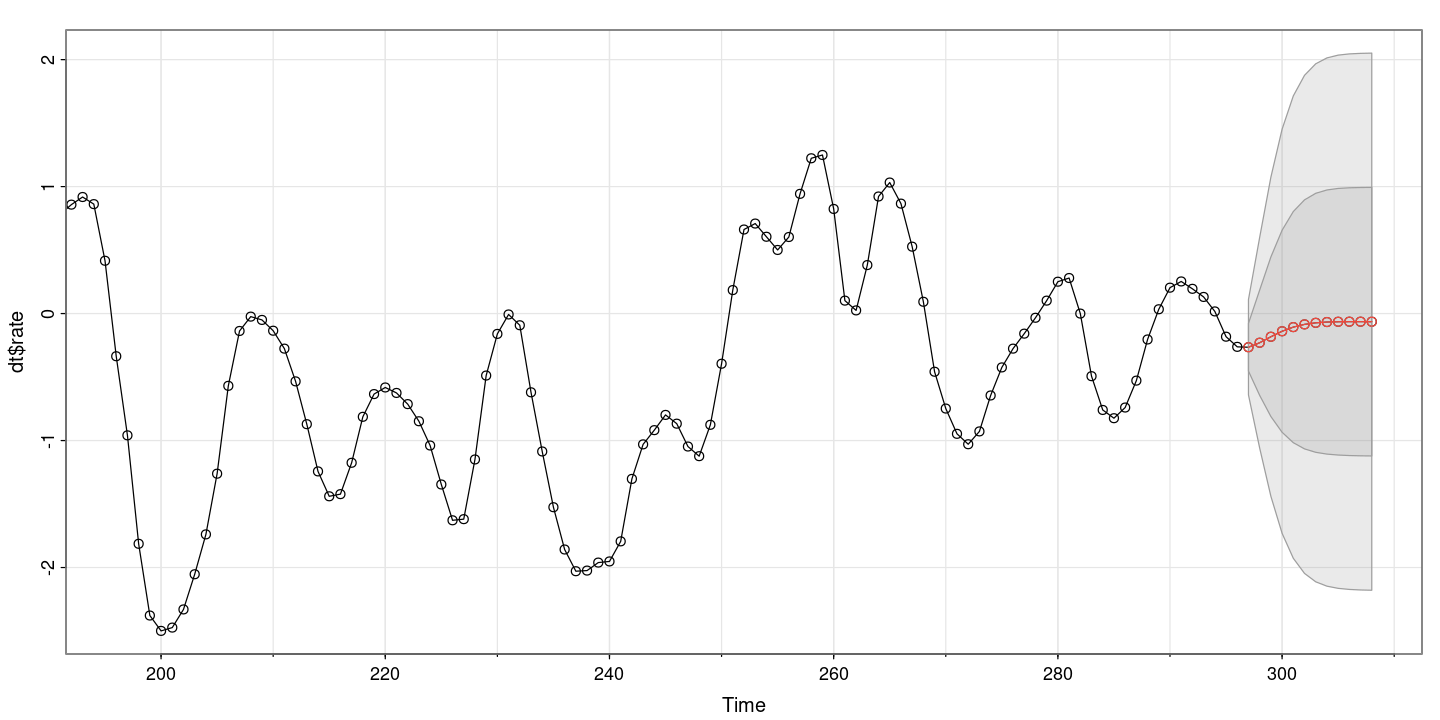

[1] -0.390455# 12시차 앞에 것을 예측해줘!!!

astsa::sarima.for(dt$rate, n.ahead=12, p=3, d=0, q=0)- $pred

- A Time Series:

- -0.265106139192775

- -0.229552377440341

- -0.182456715763015

- -0.139312468943022

- -0.106583819040958

- -0.0850525454735895

- -0.0726919904363936

- -0.0666382629913424

- -0.0642841907844162

- -0.063717844077476

- -0.0637616533051378

- -0.0638220781876669

- $se

- A Time Series:

- 0.187871938724622

- 0.414904448800112

- 0.628395849359732

- 0.795661017554752

- 0.910326093209164

- 0.98070415660671

- 1.01994737390418

- 1.04011443482053

- 1.04985151276616

- 1.05439175132729

- 1.05651197077771

- 1.05754419307717

- 신뢰구간 까지 구해준다. 신기하군..

- 과대적합을 해 볼 수도 있음 : AR(4), AR(3,1)

fit2 <- arima(dt$rate, order=c(3,0,0)) #AR(3)

fit3 <- arima(dt$rate, order=c(4,0,0)) #AR(4)

fit4 <- arima(dt$rate, order=c(3,0,1)) #ARMA(3,1)

fit5 <- arima(dt$rate, order=c(4,0,1)) #ARMA(4,1)lmtest::coeftest(fit2)

lmtest::coeftest(fit3)

lmtest::coeftest(fit4)

lmtest::coeftest(fit5)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 1.969066 0.054385 36.2061 < 2.2e-16 ***

ar2 -1.365143 0.098538 -13.8540 < 2.2e-16 ***

ar3 0.339404 0.054328 6.2473 4.177e-10 ***

intercept -0.060643 0.189800 -0.3195 0.7493

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 1.927075 0.057476 33.5284 < 2e-16 ***

ar2 -1.197232 0.125870 -9.5116 < 2e-16 ***

ar3 0.098632 0.125831 0.7838 0.43313

ar4 0.121539 0.057377 2.1183 0.03415 *

intercept -0.059332 0.212340 -0.2794 0.77992

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 2.249705 0.115834 19.4217 < 2.2e-16 ***

ar2 -1.843111 0.195373 -9.4338 < 2.2e-16 ***

ar3 0.560735 0.090945 6.1657 7.019e-10 ***

ma1 -0.320319 0.134416 -2.3830 0.01717 *

intercept -0.059321 0.220225 -0.2694 0.78765

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 2.095578 0.310005 6.7598 1.382e-11 ***

ar2 -1.527029 0.618747 -2.4679 0.01359 *

ar3 0.324392 0.445860 0.7276 0.46688

ar4 0.066838 0.123362 0.5418 0.58795

ma1 -0.172334 0.307391 -0.5606 0.57505

intercept -0.057957 0.217926 -0.2659 0.79028

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1AR(4)와 AR(3)을 비교해 보면, AR(4)에서는 ar4가 유의하긴 하지만.. *한개라서 선택안하는게 나을 듯 하다.

ARMA(3,0,1)도 그닥

ARMA(4,0,1) 공통인수가 생겨서 더 이상해졌다.

paste0("AIC for AR(3) = ", fit2$aic)

paste0("AIC for AR(4) = ", fit3$aic)

paste0("AIC for ARMA(3,1) = ", fit4$aic)

paste0("AIC for ARMA(4,1) = ", fit5$aic)- auto.aroma

- 자동으로 좋은거 찾아줘

forecast::auto.arima(dt$rate, ic='bic', test="adf", trace = T)

Fitting models using approximations to speed things up...

ARIMA(2,0,2) with non-zero mean : -108.9179

ARIMA(0,0,0) with non-zero mean : 891.9727

ARIMA(1,0,0) with non-zero mean : 194.5692

ARIMA(0,0,1) with non-zero mean : 520.7498

ARIMA(0,0,0) with zero mean : 887.1148

ARIMA(1,0,2) with non-zero mean : -68.83754

ARIMA(2,0,1) with non-zero mean : -109.6656

ARIMA(1,0,1) with non-zero mean : -11.98193

ARIMA(2,0,0) with non-zero mean : -88.26513

ARIMA(3,0,1) with non-zero mean : -117.6677

ARIMA(3,0,0) with non-zero mean : -118.7078

ARIMA(4,0,0) with non-zero mean : -116.5382

ARIMA(4,0,1) with non-zero mean : -111.1943

ARIMA(3,0,0) with zero mean : -124.2755

ARIMA(2,0,0) with zero mean : -93.73805

ARIMA(4,0,0) with zero mean : -122.1245

ARIMA(3,0,1) with zero mean : -123.2595

ARIMA(2,0,1) with zero mean : -115.215

ARIMA(4,0,1) with zero mean : -116.7881

Now re-fitting the best model(s) without approximations...

ARIMA(3,0,0) with zero mean : -122.2743

Best model: ARIMA(3,0,0) with zero mean

Series: dt$rate

ARIMA(3,0,0) with zero mean

Coefficients:

ar1 ar2 ar3

1.9696 -1.3659 0.3399

s.e. 0.0544 0.0985 0.0543

sigma^2 = 0.03567: log likelihood = 72.52

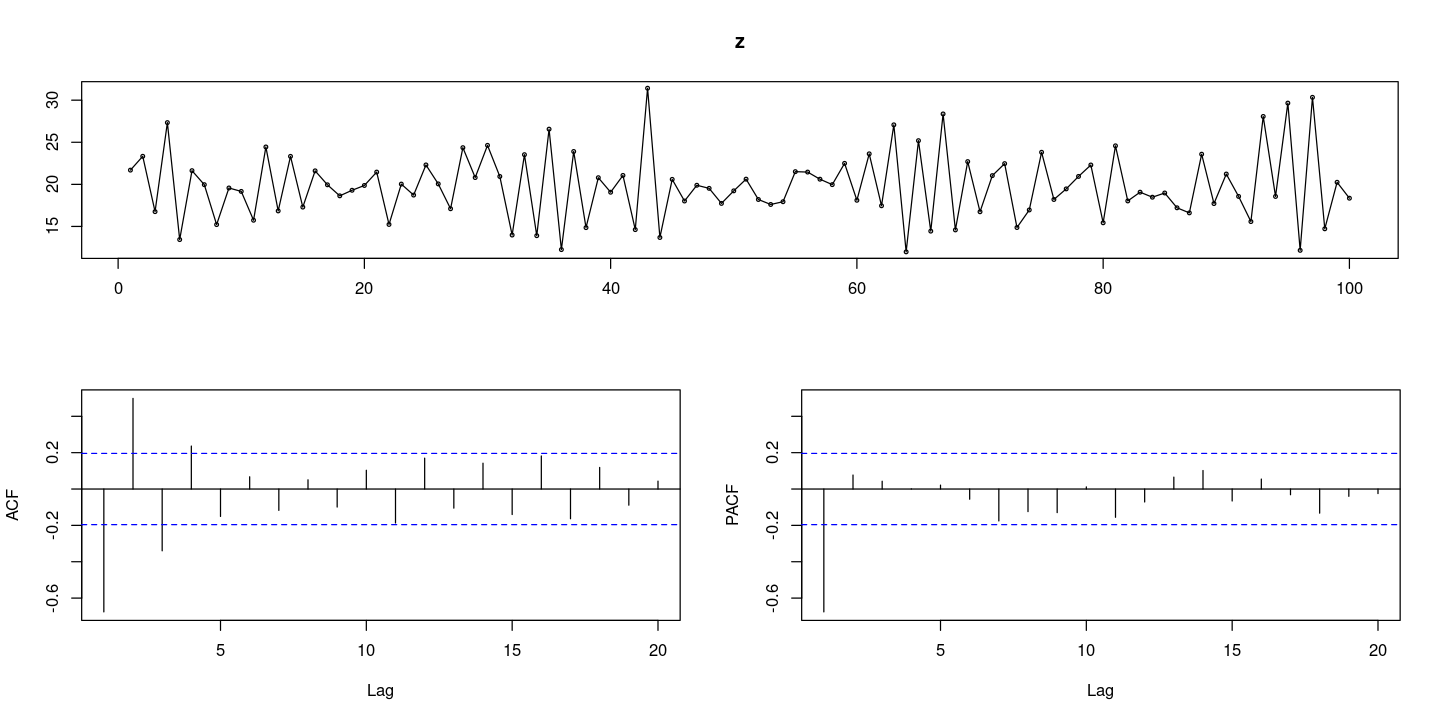

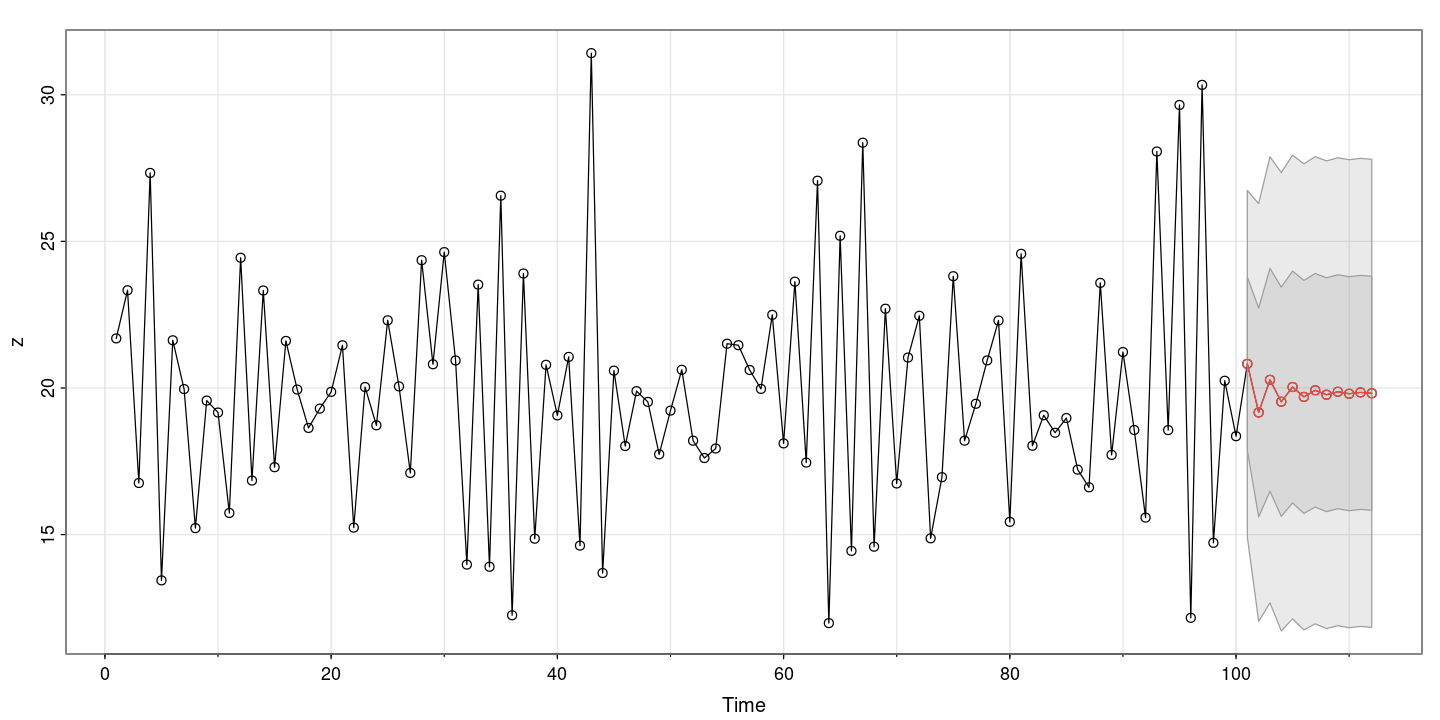

AIC=-137.04 AICc=-136.9 BIC=-122.27fit2$sigma2EX 8.7 모의 실험 데이터

z <- scan("eg8_7.txt")

forecast::tsdisplay(z)

평균이 20정도 이고 추세나 계절성분이 보이지 않는 정상 시계열

acf는 사인 함수 형태를 그리며 지수적으로 감소하는 형태

pacf는 처음만 ㅏㅅㄹ아남고 나머지는 다 0인 AR(1)모형

#모형 적합도 검정 : H0 : rho1=...=rho_k=0 WN

Box.test(z, lag=1, type = "Ljung-Box")

Box.test(z, lag=6, type = "Ljung-Box")

Box.test(z, lag=12, type = "Ljung-Box")

Box-Ljung test

data: z

X-squared = 47.058, df = 1, p-value = 6.892e-12

Box-Ljung test

data: z

X-squared = 93.925, df = 6, p-value < 2.2e-16

Box-Ljung test

data: z

X-squared = 105.37, df = 12, p-value < 2.2e-16모든 시차에서 다 기각을 한다.

WN가 아니다.

## 단위근 검정 H0 : 단위근이 있다.

fUnitRoots::adfTest(z, lags = 0, type = "c")

fUnitRoots::adfTest(z, lags = 1, type = "c")

fUnitRoots::adfTest(z, lags = 2, type = "c")Warning message in fUnitRoots::adfTest(z, lags = 0, type = "c"):

“p-value smaller than printed p-value”

Warning message in fUnitRoots::adfTest(z, lags = 1, type = "c"):

“p-value smaller than printed p-value”

Warning message in fUnitRoots::adfTest(z, lags = 2, type = "c"):

“p-value smaller than printed p-value”

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 0

STATISTIC:

Dickey-Fuller: -22.4468

P VALUE:

0.01

Description:

Tue Nov 28 22:50:24 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -8.4607

P VALUE:

0.01

Description:

Tue Nov 28 22:50:24 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 2

STATISTIC:

Dickey-Fuller: -5.98

P VALUE:

0.01

Description:

Tue Nov 28 22:50:24 2023 by user: - 다 기각! 단위근이 없다. 차분을 할 필요가 없다.!!

## 모형적합 AR(1)

fit <- arima(z,order=c(1,0,0))

summary(fit)

Call:

arima(x = z, order = c(1, 0, 0))

Coefficients:

ar1 intercept

-0.6715 19.8312

s.e. 0.0728 0.1776

sigma^2 estimated as 8.744: log likelihood = -250.61, aic = 507.22

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.007670341 2.957007 2.337302 -2.080783 11.9899 0.4096807

ACF1

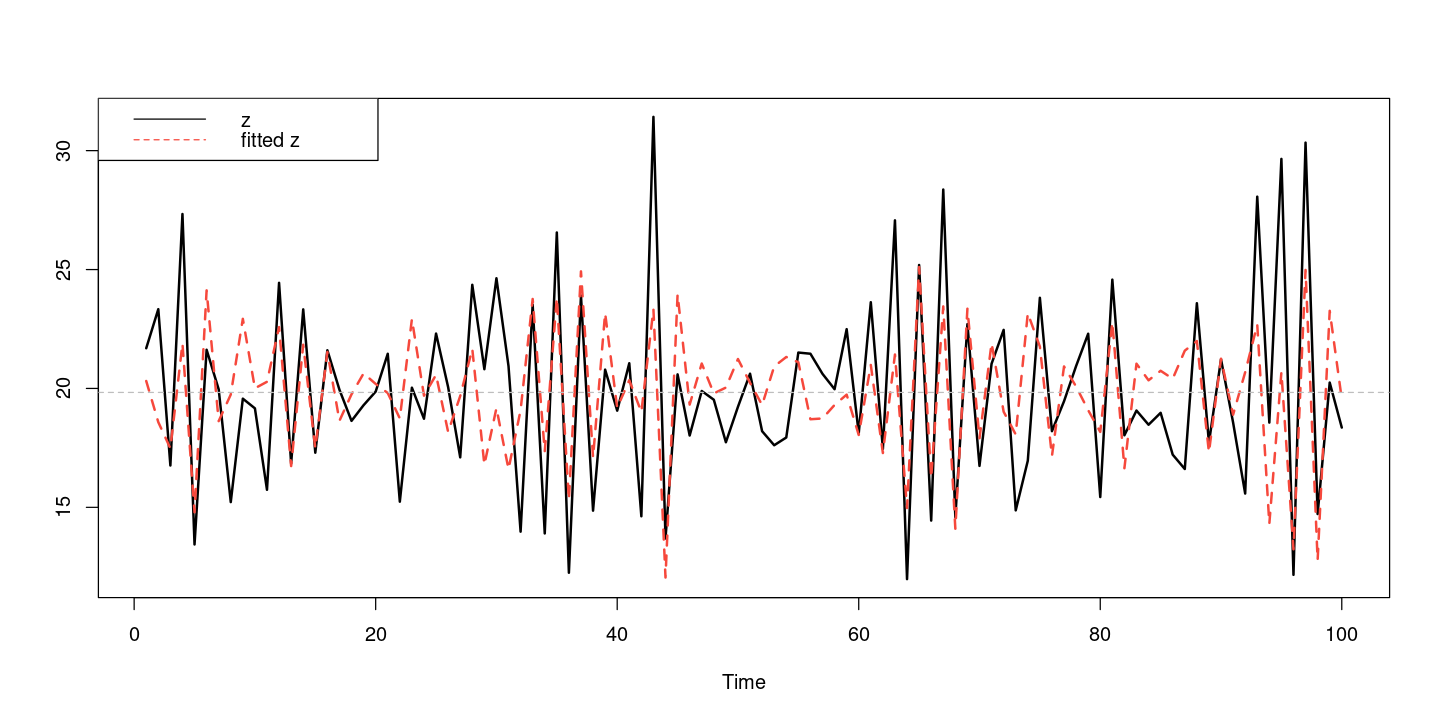

Training set 0.04344908ts.plot(z, fitted(fit), col=1:2, lty=1:2, lwd=2)

abline(h=mean(z), col="grey", lty=2)

legend("topleft", c("z", "fitted z"), col=1:2, lty=1:2)

sum((z - fitted(fit))^2) #SSE

sum((z - fitted(fit))^2) / 100 #MSE

sqrt(sum((z - fitted(fit))^2) / 100) #RMSE

sum(abs(z-fitted(fit))/100) #MAE

sum(abs(z-fitted(fit))/z)*100/100 #MAPElmtest::coeftest(fit)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 -0.671544 0.072838 -9.2197 < 2.2e-16 ***

intercept 19.831150 0.177618 111.6504 < 2.2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1fit$sigma2(1-0.67)*19.83 # delta- AR(1)

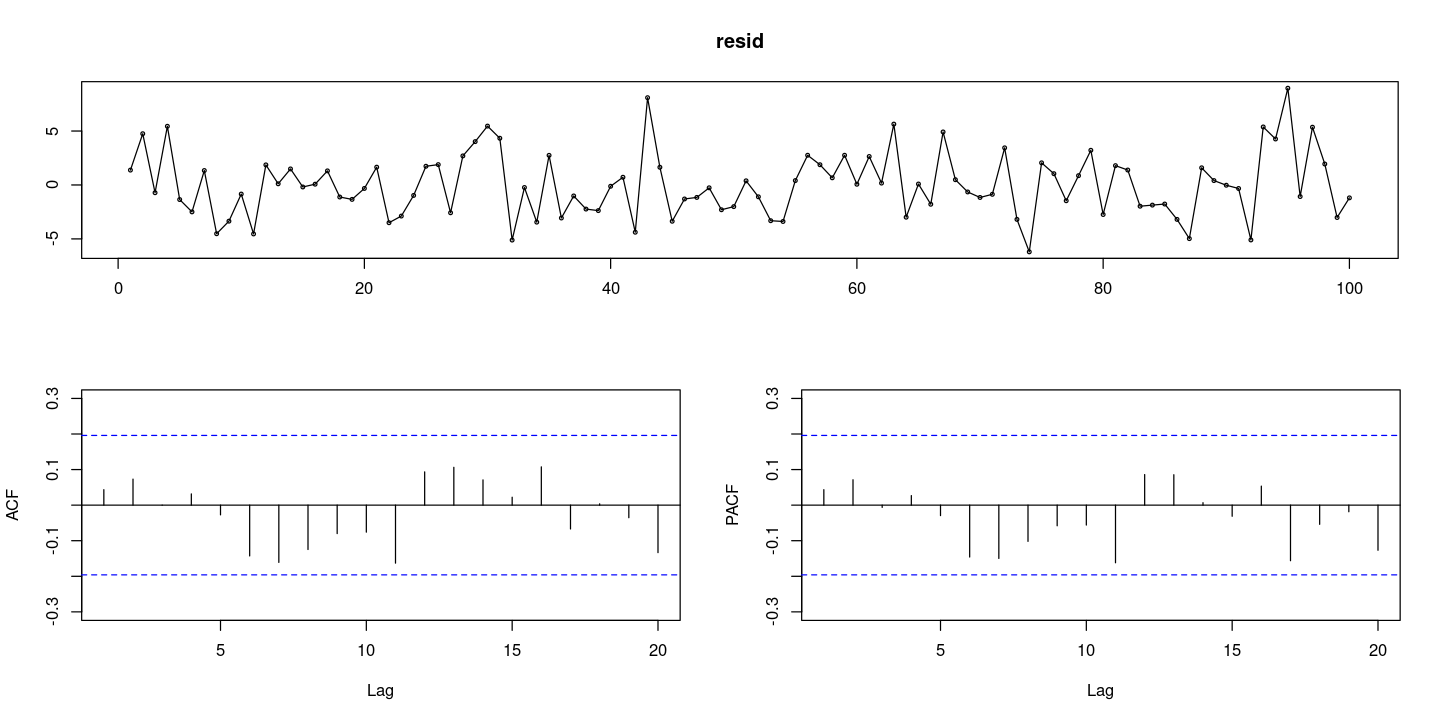

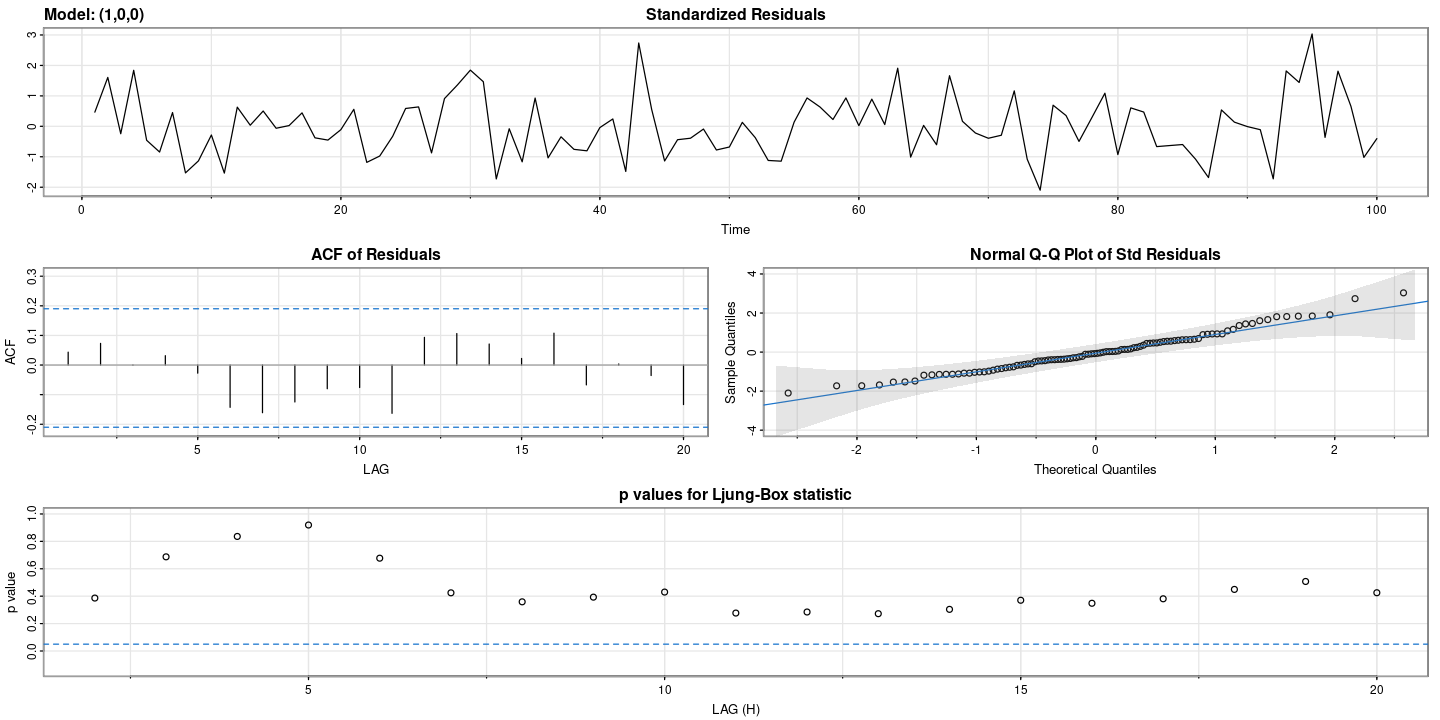

- 잔차분석

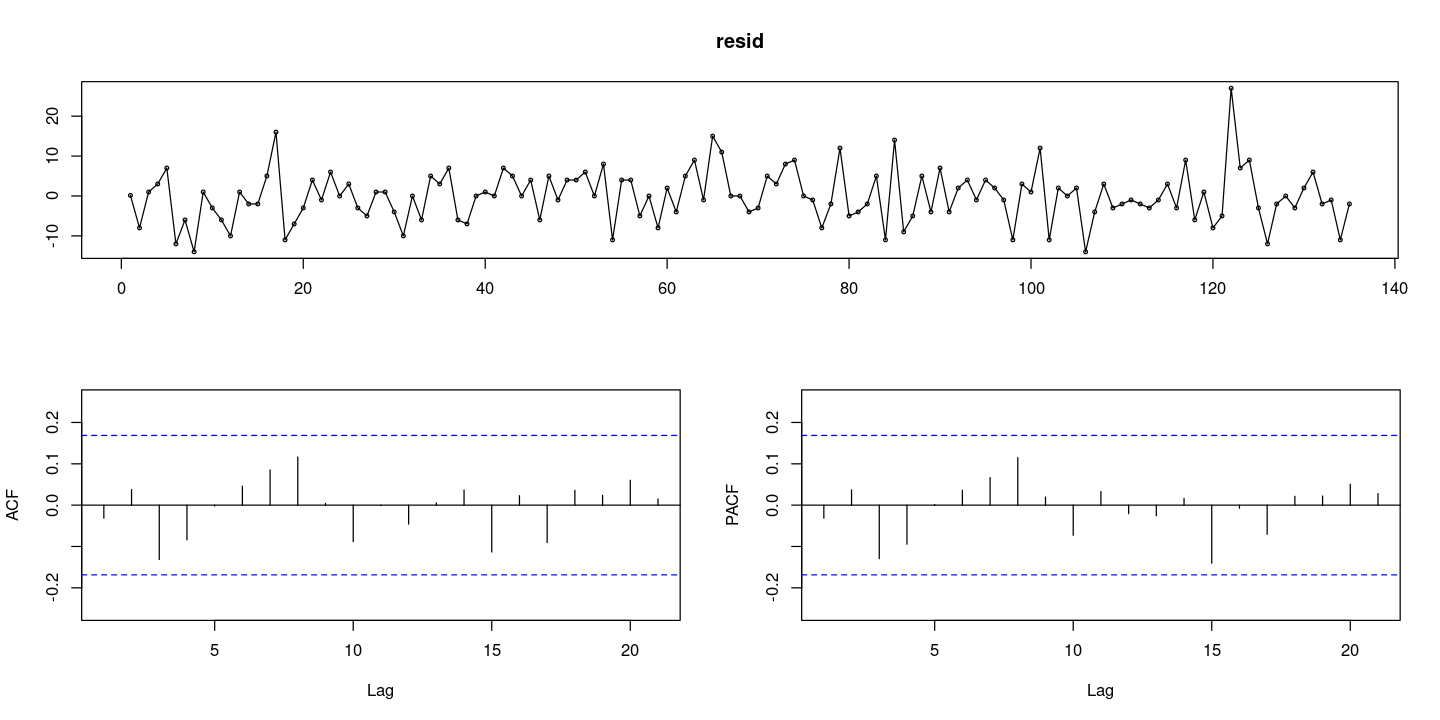

resid = resid(fit)

forecast::tsdisplay(resid)

# 잔차의 포트맨토 검정 ## H0 : rho1=...=rho_k=0

portes::LjungBox(fit, lags=c(6,12,18,24))| lags | statistic | df | p-value | |

|---|---|---|---|---|

| 6 | 3.147291 | 5 | 0.6772898 | |

| 12 | 13.135047 | 11 | 0.2845906 | |

| 18 | 17.072699 | 17 | 0.4494514 | |

| 24 | 24.393987 | 23 | 0.3822679 |

- H0기각 못함. 다 0이다! WN이다.

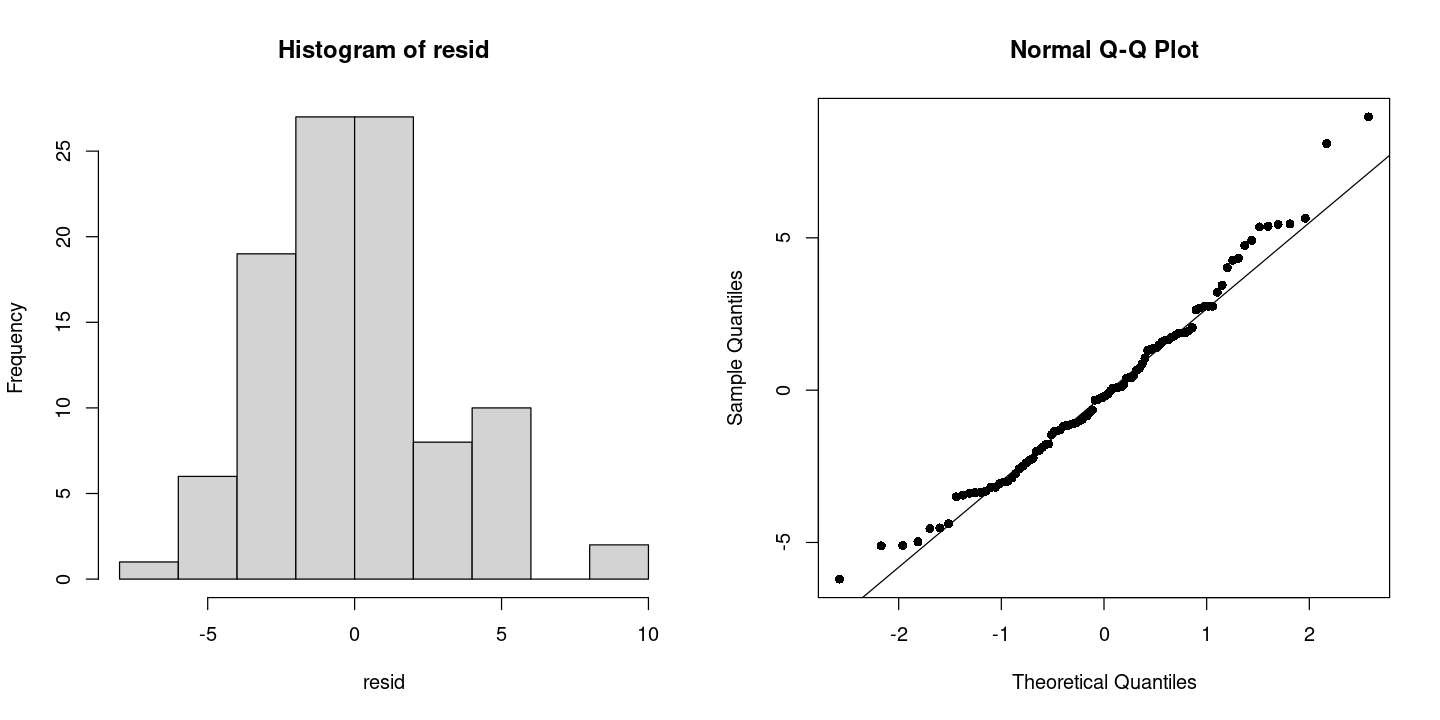

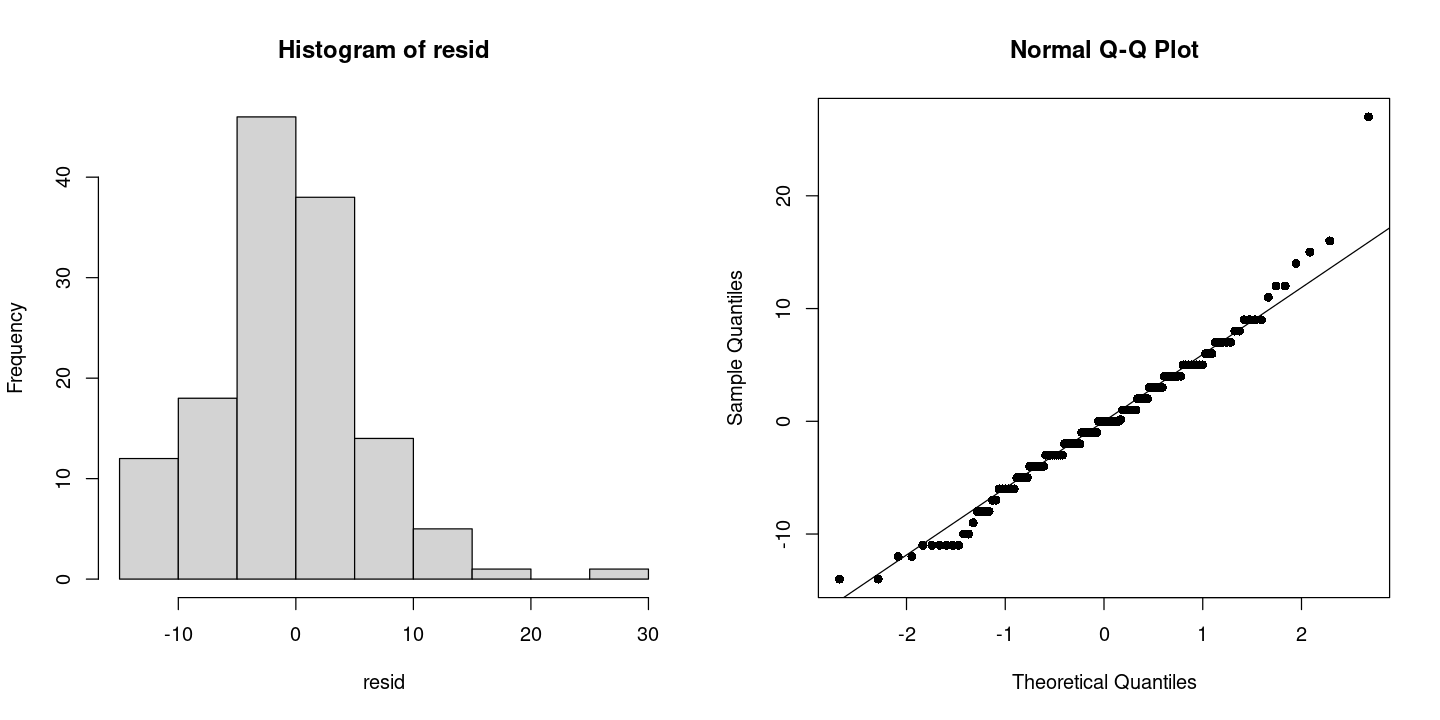

## 정규성검정

tseries::jarque.bera.test(resid) ##JB test H0: norma

Jarque Bera Test

data: resid

X-squared = 4.2649, df = 2, p-value = 0.1185par(mfrow=c(1,2))

hist(resid)

qqnorm(resid, pch=16)

qqline(resid)

- 정규분포이다.

## 잔차 검정

astsa::sarima(z, p=1, d=0, q=0)initial value 1.394650

iter 2 value 1.088119

iter 3 value 1.088089

iter 4 value 1.088089

iter 5 value 1.088089

iter 5 value 1.088089

iter 5 value 1.088089

final value 1.088089

converged

initial value 1.087203

iter 2 value 1.087196

iter 3 value 1.087176

iter 4 value 1.087176

iter 4 value 1.087176

iter 4 value 1.087176

final value 1.087176

converged$fit

Call:

arima(x = xdata, order = c(p, d, q), seasonal = list(order = c(P, D, Q), period = S),

xreg = xmean, include.mean = FALSE, transform.pars = trans, fixed = fixed,

optim.control = list(trace = trc, REPORT = 1, reltol = tol))

Coefficients:

ar1 xmean

-0.6715 19.8312

s.e. 0.0728 0.1776

sigma^2 estimated as 8.744: log likelihood = -250.61, aic = 507.22

$degrees_of_freedom

[1] 98

$ttable

Estimate SE t.value p.value

ar1 -0.6715 0.0728 -9.2197 0

xmean 19.8312 0.1776 111.6504 0

$AIC

[1] 5.072228

$AICc

[1] 5.073466

$BIC

[1] 5.150384

astsa::sarima.for(z, n.ahead=12, p=1, d=0, q=0)- $pred

- A Time Series:

- 20.8222483489762

- 19.1655839559512

- 20.2781070098918

- 19.5309988141942

- 20.032714849742

- 19.6957904500696

- 19.9220500133516

- 19.7701067583474

- 19.8721433414928

- 19.8036212850204

- 19.849636861772

- 19.8187353767205

- $se

- A Time Series:

- 2.95700711959937

- 3.5619005566917

- 3.80334404182832

- 3.90734998536685

- 3.95335857242263

- 3.97393285636323

- 3.98317649989949

- 3.98733810739122

- 3.98921345277822

- 3.99005889146209

- 3.99044010149264

- 3.9906120043846

- 과대적합 AR(2), ARMA(1,1)

fit1 <- arima(z,order=c(1,0,0)) #AR(1)

fit2 <- arima(z,order=c(2,0,0)) #AR(2)

fit3 <- arima(z,order=c(1,0,1)) #ARMA(1,1)lmtest::coeftest(fit1)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 -0.671544 0.072838 -9.2197 < 2.2e-16 ***

intercept 19.831150 0.177618 111.6504 < 2.2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1lmtest::coeftest(fit2)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 -0.623116 0.100156 -6.2215 4.925e-10 ***

ar2 0.070388 0.100264 0.7020 0.4827

intercept 19.833114 0.190583 104.0657 < 2.2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1- ar2가 유의하지 앟네? 없어도 된다.

lmtest::coeftest(fit3)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 -0.721425 0.097566 -7.3942 1.423e-13 ***

ma1 0.092687 0.139500 0.6644 0.5064

intercept 19.832916 0.187938 105.5291 < 2.2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1- 얘도 추가한게 의미가 없다리

paste0("AIC for AR(1) = ", fit1$aic)

paste0("AIC for AR(2) = ", fit2$aic)

paste0("AIC for ARMA(1,1) = ", fit3$aic)fit1$sigma2

fit2$sigma2

fit3$sigma2- 자유도를 고려하지 않기 때문에 크게 차이는 없ㅈ만.. 선택할 필요는 없다.

forecast::auto.arima(z, trace = T)

ARIMA(2,0,2) with non-zero mean : 513.4708

ARIMA(0,0,0) with non-zero mean : 566.0505

ARIMA(1,0,0) with non-zero mean : 507.4728

ARIMA(0,0,1) with non-zero mean : 529.1392

ARIMA(0,0,0) with zero mean : 887.3166

ARIMA(2,0,0) with non-zero mean : 509.1524

ARIMA(1,0,1) with non-zero mean : 509.2078

ARIMA(2,0,1) with non-zero mean : 511.2473

ARIMA(1,0,0) with zero mean : 686.5421

Best model: ARIMA(1,0,0) with non-zero mean

Series: z

ARIMA(1,0,0) with non-zero mean

Coefficients:

ar1 mean

-0.6715 19.8312

s.e. 0.0728 0.1776

sigma^2 = 8.922: log likelihood = -250.61

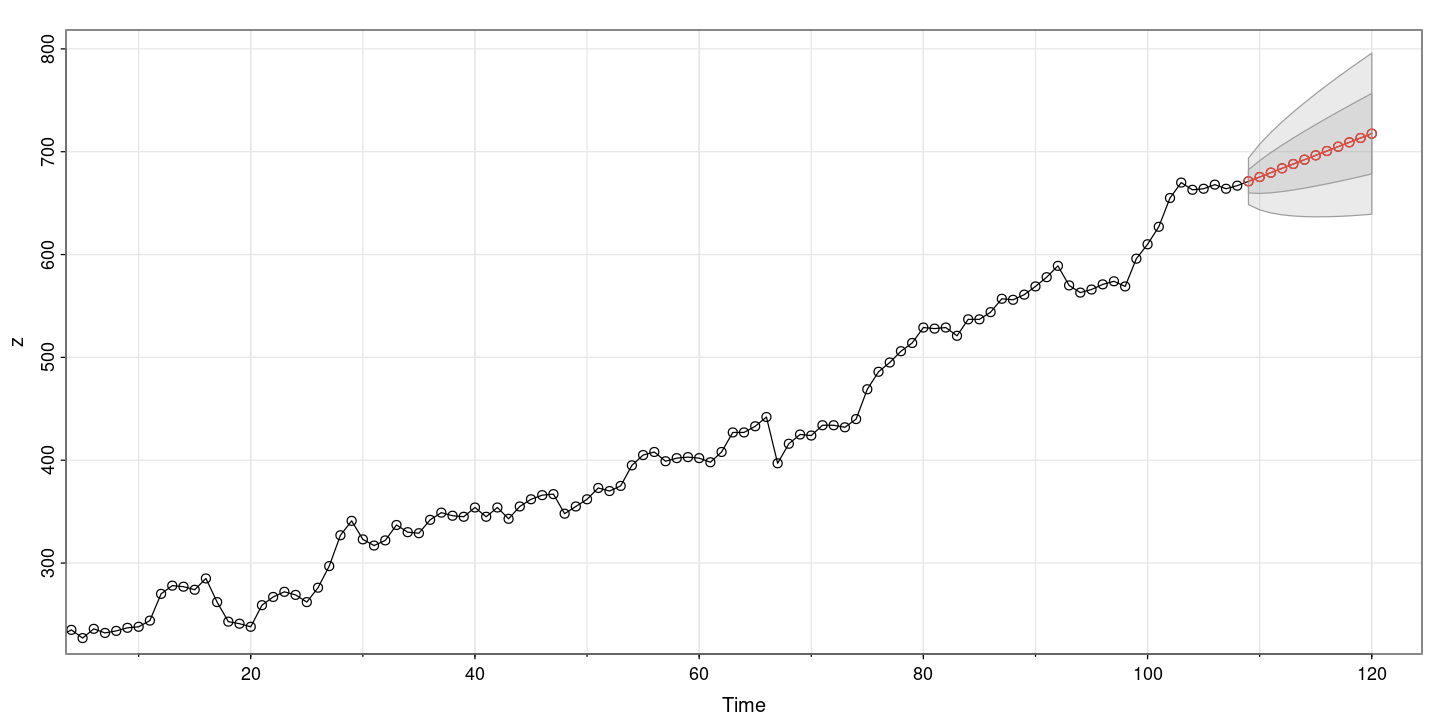

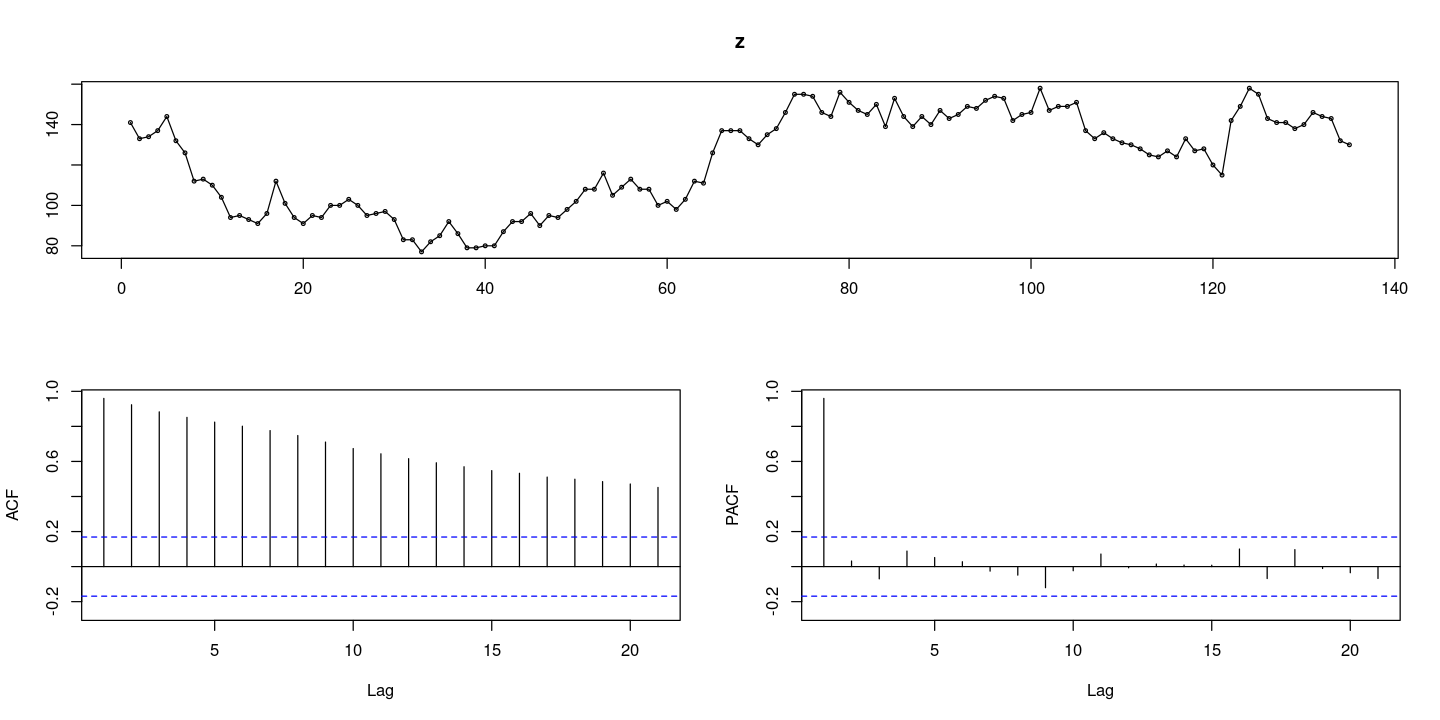

AIC=507.22 AICc=507.47 BIC=515.04EX 8.8 : 주가지수

z <- scan("elecstock.txt")

forecast::tsdisplay(z)

추세는 있으나 결정적 추세가 아닌 확률적 추세가 있어 보인다..

acf는 서서히 감소하고 pacf는 첫번째만 있는 거 보니 차분이 필요해 보이낟.

## 단위근 검정 H0 : 단위근이 있다.(phi=1) H1 : |phi|<1

fUnitRoots::adfTest(z, lags = 0, type = "c")

fUnitRoots::adfTest(z, lags = 1, type = "c")

fUnitRoots::adfTest(z, lags = 2, type = "c")

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 0

STATISTIC:

Dickey-Fuller: -1.6769

P VALUE:

0.434

Description:

Tue Nov 28 22:59:53 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -1.5572

P VALUE:

0.4784

Description:

Tue Nov 28 22:59:53 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 2

STATISTIC:

Dickey-Fuller: -1.629

P VALUE:

0.4517

Description:

Tue Nov 28 22:59:53 2023 by user: 기각을 못한다!! 차분이 필요해.

평균이 0이 아니니까 type=c 쓰는거 주의하자.

- 위의 함수 외에도 단위근 검정 함수는 아래 더 있음.

tseries::adf.test(z)

Augmented Dickey-Fuller Test

data: z

Dickey-Fuller = -2.6174, Lag order = 5, p-value = 0.3197

alternative hypothesis: stationarytseries::pp.test(z)

Phillips-Perron Unit Root Test

data: z

Dickey-Fuller Z(alpha) = -10.981, Truncation lag parameter = 4, p-value

= 0.4825

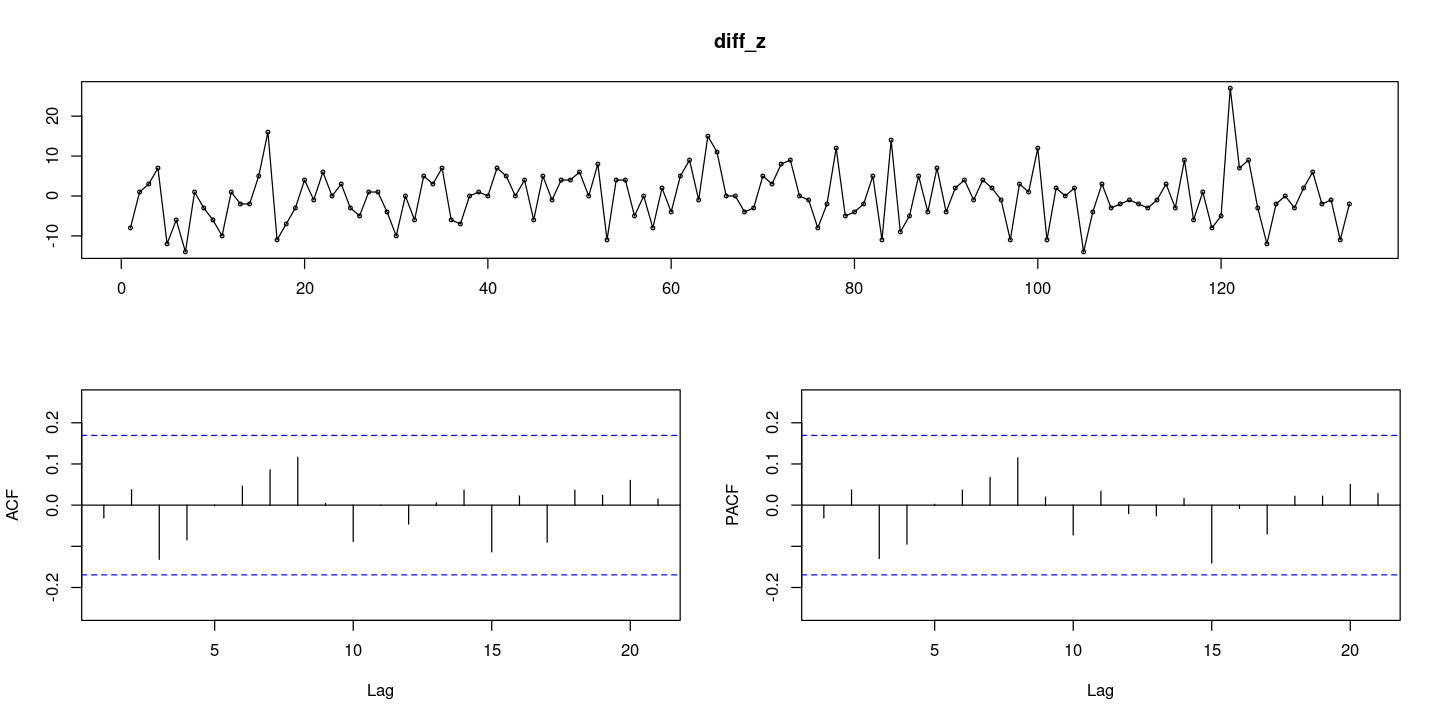

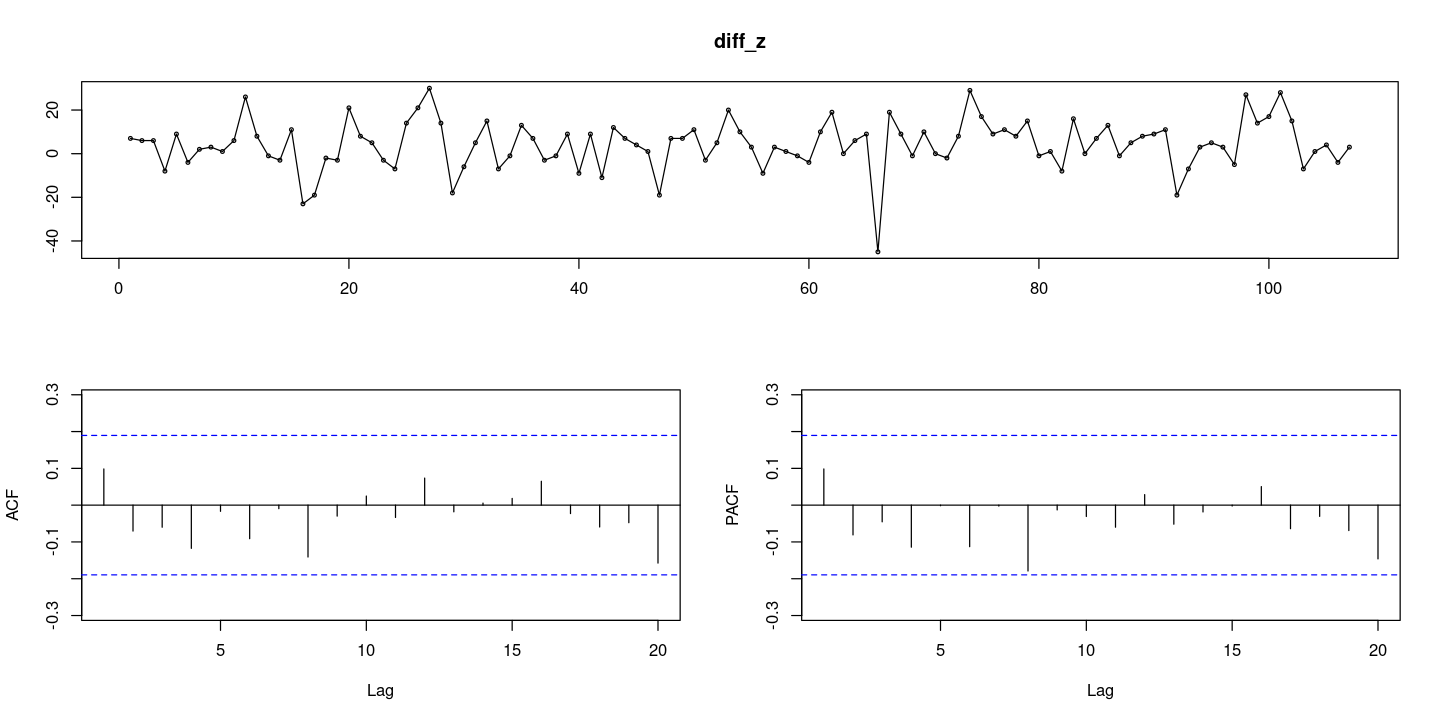

alternative hypothesis: stationary## 차분

diff_z = diff(z)

forecast::tsdisplay(diff_z)

차분을 했더니 0을 중심으로 움직이고 있다..

acf/pacf 모든 차수에서 다 0이니까 WN이다! 엇, 그럼 랜덤워크네?

## 포투맨트검정 H0 : rho1=...=rho_k=0

Box.test(diff_z, lag=6, type = "Ljung-Box")

Box.test(diff_z, lag=12, type = "Ljung-Box")

Box-Ljung test

data: diff_z

X-squared = 4.0392, df = 6, p-value = 0.6714

Box-Ljung test

data: diff_z

X-squared = 8.5057, df = 12, p-value = 0.7445- 기각을 못한다. WN이다.

#평균

t.test(diff_z)

One Sample t-test

data: diff_z

t = -0.14564, df = 133, p-value = 0.8844

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-1.196970 1.032791

sample estimates:

mean of x

-0.08208955 평균이 0이라고 할 수 있다.

따라서,

## 모형적합 ARIMA(0,1,0)

fit <- arima(z,order=c(0,1,0))

summary(fit)

Call:

arima(x = z, order = c(0, 1, 0))

sigma^2 estimated as 42.26: log likelihood = -440.98, aic = 883.95

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -0.08043704 6.47675 4.897341 -0.2029409 4.084668 0.9928043

ACF1

Training set -0.03158845fit$sigma2### 잔차검정

resid <- resid(fit)

forecast::tsdisplay(resid)

## 정규성검정

tseries::jarque.bera.test(resid) ##JB test H0: normal

Jarque Bera Test

data: resid

X-squared = 19.063, df = 2, p-value = 7.254e-05- 유의확률이 작게 나와서 정규분포라 하기는 어렵다.. (이상점 떄문에 꼬리)

par(mfrow=c(1,2))

hist(resid)

qqnorm(resid, pch=16)

qqline(resid)

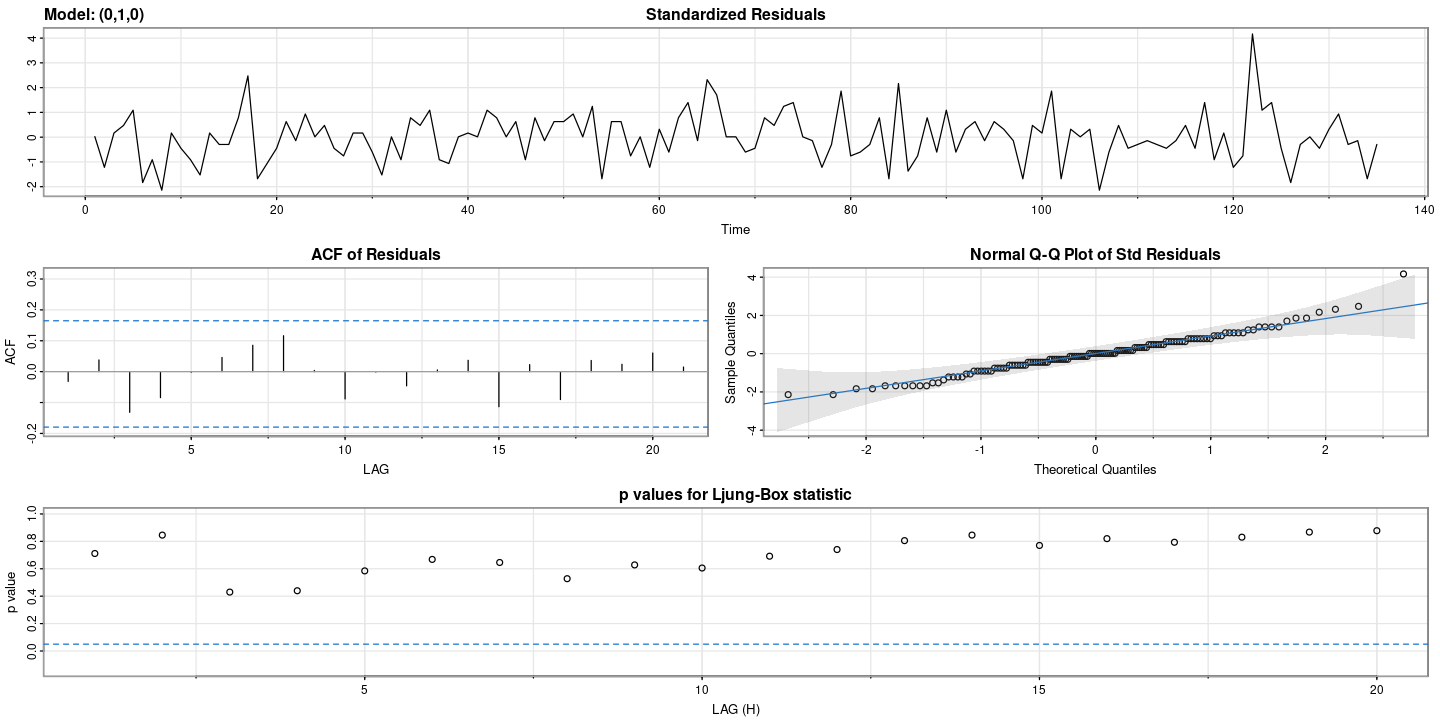

# 잔차의 포트맨토 검정 ## H0 : rho1=...=rho_k=0

portes::LjungBox(fit, lags=c(6,12,18,24))| lags | statistic | df | p-value | |

|---|---|---|---|---|

| 6 | 4.057476 | 6 | 0.6688985 | |

| 12 | 8.548020 | 12 | 0.7409734 | |

| 18 | 12.308859 | 18 | 0.8308883 | |

| 24 | 17.491184 | 24 | 0.8269712 |

- 다 유의하지 않다. 따라서 WN이다.

## 잔차 검정

astsa::sarima(z, p=0, d=1, q=0)initial value 1.871855

iter 1 value 1.871855

final value 1.871855

converged

initial value 1.871855

iter 1 value 1.871855

final value 1.871855

converged$fit

Call:

arima(x = xdata, order = c(p, d, q), seasonal = list(order = c(P, D, Q), period = S),

xreg = constant, transform.pars = trans, fixed = fixed, optim.control = list(trace = trc,

REPORT = 1, reltol = tol))

Coefficients:

constant

-0.0821

s.e. 0.5615

sigma^2 estimated as 42.25: log likelihood = -440.97, aic = 885.93

$degrees_of_freedom

[1] 133

$ttable

Estimate SE t.value p.value

constant -0.0821 0.5615 -0.1462 0.884

$AIC

[1] 6.611438

$AICc

[1] 6.611664

$BIC

[1] 6.654689

astsa::sarima.for(z, n.ahead=12, p=0, d=1, q=0)- $pred

- A Time Series:

- 129.917910447761

- 129.835820895522

- 129.753731343284

- 129.671641791045

- 129.589552238806

- 129.507462686567

- 129.425373134328

- 129.343283582089

- 129.261194029851

- 129.179104477612

- 129.097014925373

- 129.014925373134

- $se

- A Time Series:

- 6.50034270906296

- 9.1928728192299

- 11.258923838707

- 13.0006854181259

- 14.5352081745099

- 15.9225227904251

- 17.1982902448725

- 18.3857456384598

- 19.5010281271889

- 20.5558885323082

- 21.5591977746842

- 22.5178476774139

EX 8.9 : 여성근로자수

z <- scan("female.txt")

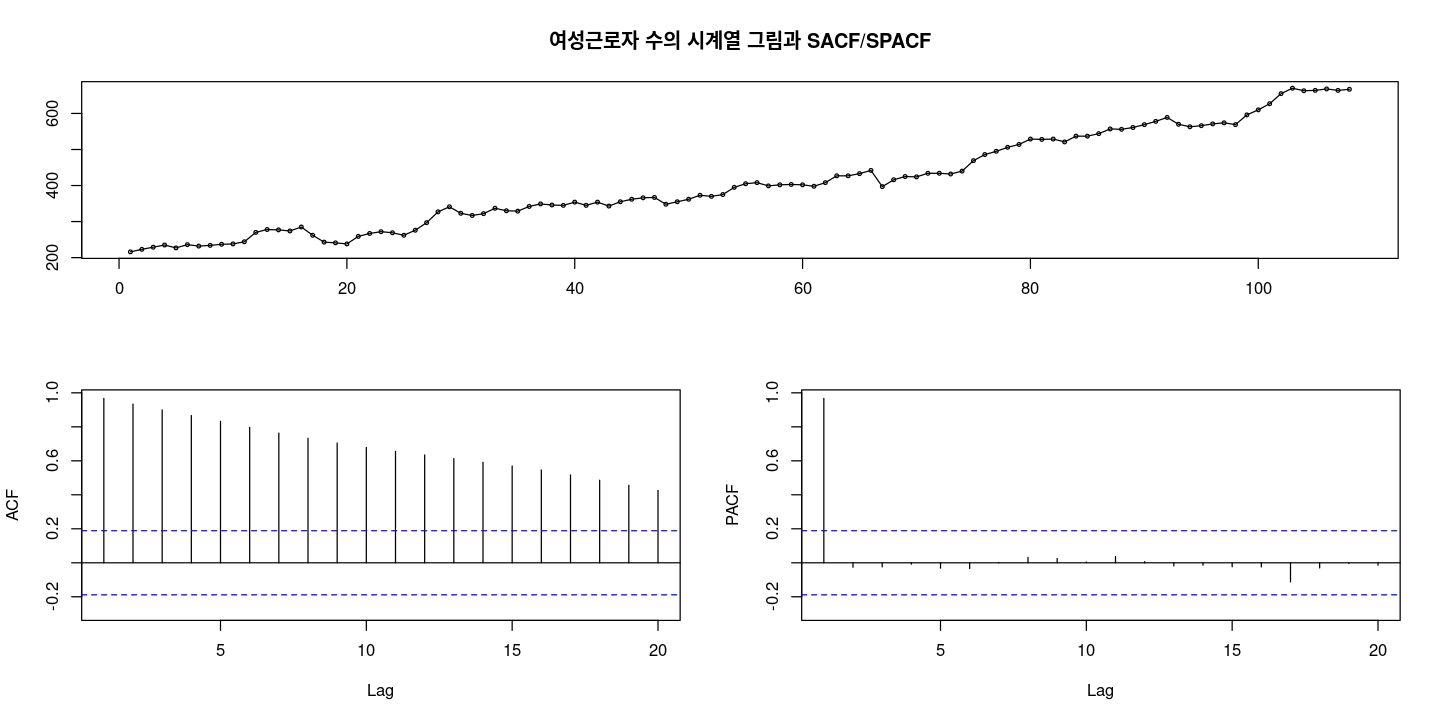

forecast::tsdisplay(z, main = "여성근로자 수의 시계열 그림과 SACF/SPACF")

결정적 추세가 있어 보인다!

ACF: 천천히 감소.. —> 차분이 필요해!

PACF:처음만 살아있다.

## 단위근 검정 H0 : 단위근이 있다.

fUnitRoots::adfTest(z, lags = 0, type = "ct")

fUnitRoots::adfTest(z, lags = 1, type = "ct")

fUnitRoots::adfTest(z, lags = 2, type = "ct")

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 0

STATISTIC:

Dickey-Fuller: -2.1323

P VALUE:

0.5217

Description:

Tue Nov 28 23:05:01 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -2.4926

P VALUE:

0.3723

Description:

Tue Nov 28 23:05:01 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 2

STATISTIC:

Dickey-Fuller: -2.3453

P VALUE:

0.4334

Description:

Tue Nov 28 23:05:01 2023 by user: - 차분이 필요하다.

tseries::adf.test(z) # ADF 검정

Augmented Dickey-Fuller Test

data: z

Dickey-Fuller = -1.9012, Lag order = 4, p-value = 0.6176

alternative hypothesis: stationarytseries::pp.test(z) # PP 검정

Phillips-Perron Unit Root Test

data: z

Dickey-Fuller Z(alpha) = -10.735, Truncation lag parameter = 4, p-value

= 0.494

alternative hypothesis: stationary분해법

################################

## 회귀모형

t <- 1:length(z)

fit1 <- lm(z~t)

summary(fit1)

## hat Tt = 186.35 + 4.07t

## Zt = Tt + It = b0 + b1t + et

Call:

lm(formula = z ~ t)

Residuals:

Min 1Q Median 3Q Max

-62.372 -17.080 0.326 16.135 63.929

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 186.34978 5.00807 37.21 <2e-16 ***

t 4.07496 0.07976 51.09 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 25.84 on 106 degrees of freedom

Multiple R-squared: 0.961, Adjusted R-squared: 0.9606

F-statistic: 2610 on 1 and 106 DF, p-value: < 2.2e-16- 모형이 다 유의하다

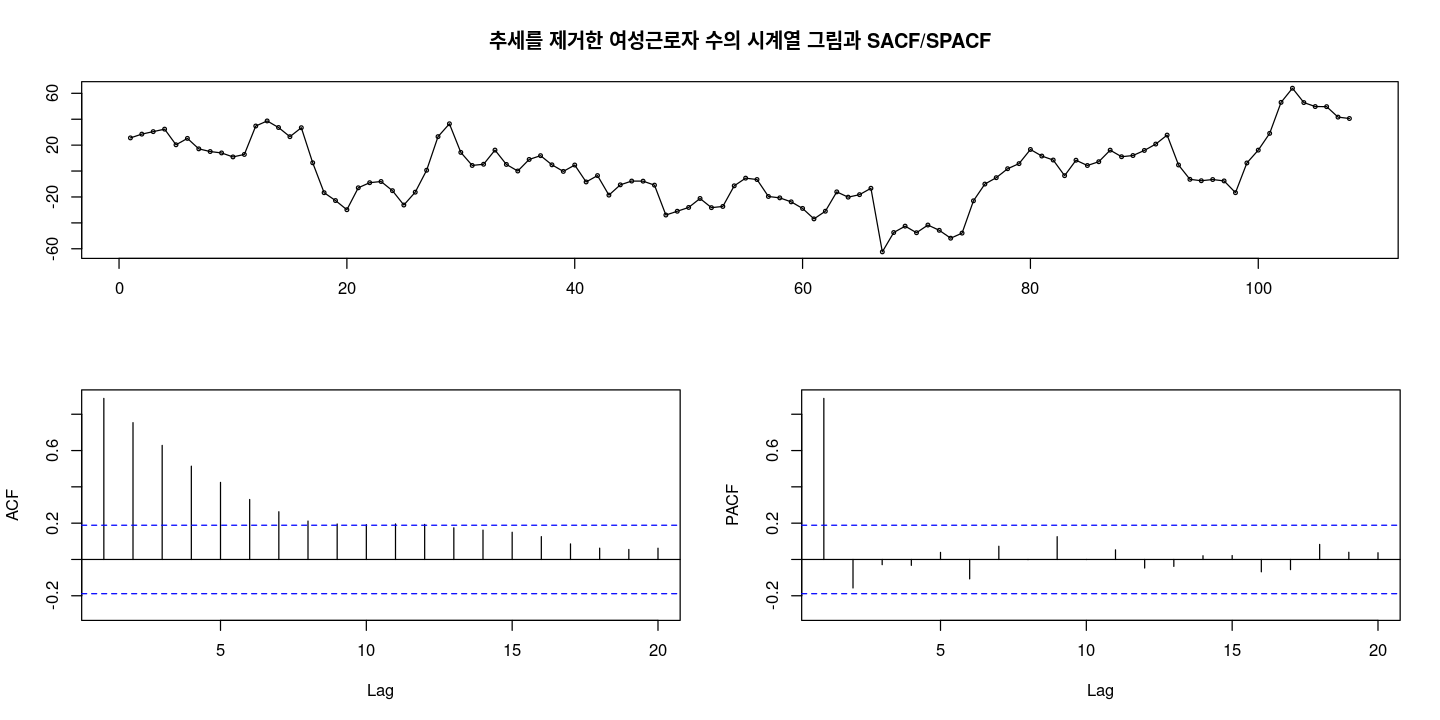

et <- z - fitted(fit1) #추세 제거

forecast::tsdisplay(et, main = "추세를 제거한 여성근로자 수의 시계열 그림과 SACF/SPACF")

- 0을 중심으로 대칭인것처럼 보이지만.. 확률적 추세가 있어 보이기도 한다..

##H0 : rho1 = ... = rho6 = 0

Box.test(et, lag=6, type = "Ljung-Box")

##H0 : rho1 = ... = rho12 = 0

Box.test(et, lag=12, type = "Ljung-Box")

Box-Ljung test

data: et

X-squared = 259.33, df = 6, p-value < 2.2e-16

Box-Ljung test

data: et

X-squared = 291.08, df = 12, p-value < 2.2e-16- pvalur가 작으니까 오차항이 WN은 아니다.

#H0 : phi=1

fUnitRoots::adfTest(et, lags = 0, type = "nc")

fUnitRoots::adfTest(et, lags = 1, type = "nc")

fUnitRoots::adfTest(et, lags = 2, type = "nc")

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 0

STATISTIC:

Dickey-Fuller: -2.1707

P VALUE:

0.03095

Description:

Tue Nov 28 23:08:43 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -2.5412

P VALUE:

0.01241

Description:

Tue Nov 28 23:08:43 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 2

STATISTIC:

Dickey-Fuller: -2.4091

P VALUE:

0.01793

Description:

Tue Nov 28 23:08:43 2023 by user: - H0기각할 수 있다. 차분이 필요하지 않다.

-

t.test(et)

One Sample t-test

data: et

t = -1.8089e-15, df = 107, p-value = 1

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-4.906433 4.906433

sample estimates:

mean of x

-4.477064e-15 ###### lm (1차추세 모형)

###### et ~ AR(1)

fit_et <- arima(et, order=c(1,0,0),

include.mean = F) ## et

summary(fit_et)

Call:

arima(x = et, order = c(1, 0, 0), include.mean = F)

Coefficients:

ar1

0.9077

s.e. 0.0402

sigma^2 estimated as 122.3: log likelihood = -413.68, aic = 831.37

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set 0.2034053 11.06091 8.125101 -113.0911 259.426 0.9717878 0.1427947파이:0.9077 <- 절대값이 1보다 작으므로 정상 시계열이라고 생각할 수 있다.

1에 가까운 값이니까. 파이^K으로 감소하니까.. 천천히 감소하는 것처럼 보임(acf그래프에서)

lmtest::coeftest(fit_et)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 0.907703 0.040184 22.588 < 2.2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1- 유의확률이 작게 나와서 정규분포라 하기는 어렵다.. (이상점 떄문에 꼬리)

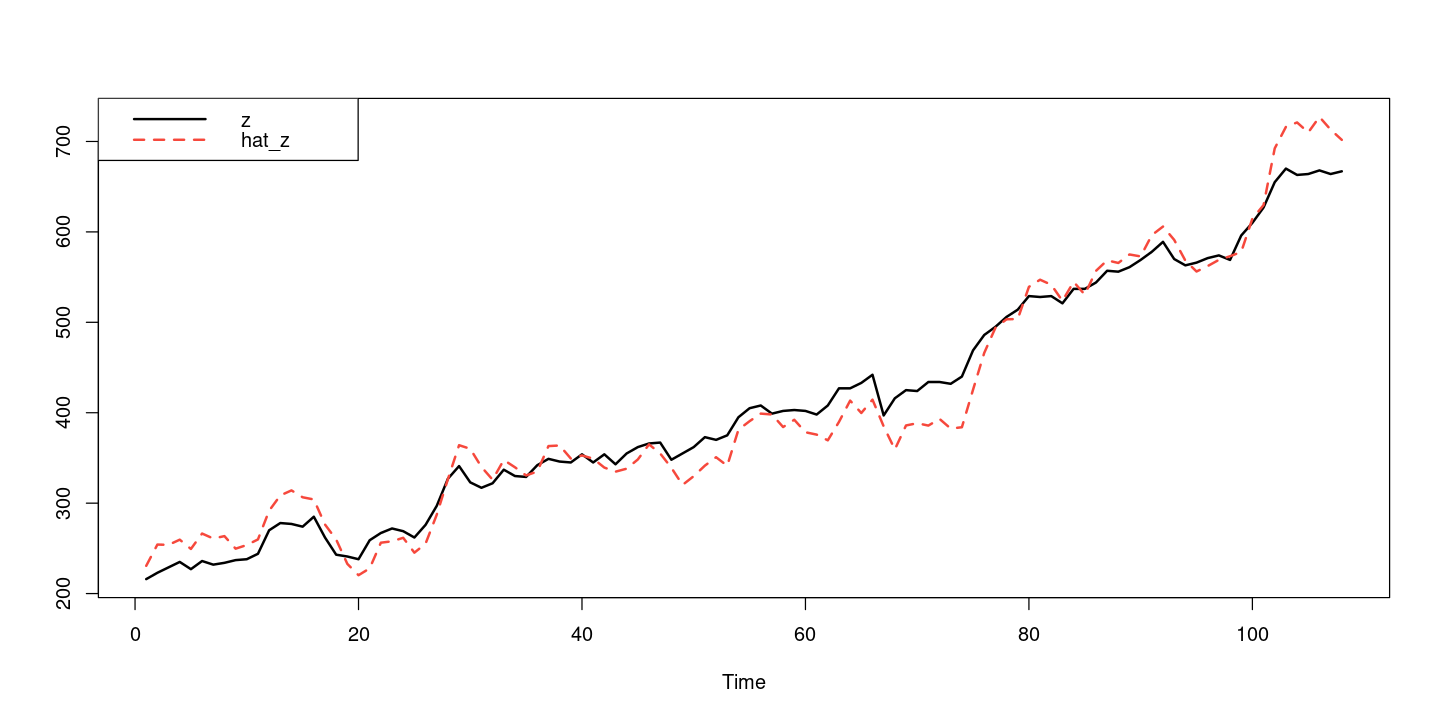

- 결정적 추세를 분해법을 사용하여 제거한 후 불규칙 성분에 대해 모형 적합 결과

#hat_zt = hat_Tt + hat_et

hat_zt = fitted(fit) + fitted(fit_et)

ts.plot(z, hat_zt, col=1:2, lty=1:2, lwd=2)

legend("topleft", c("z","hat_z"), col=1:2, lty=1:2, lwd=2)

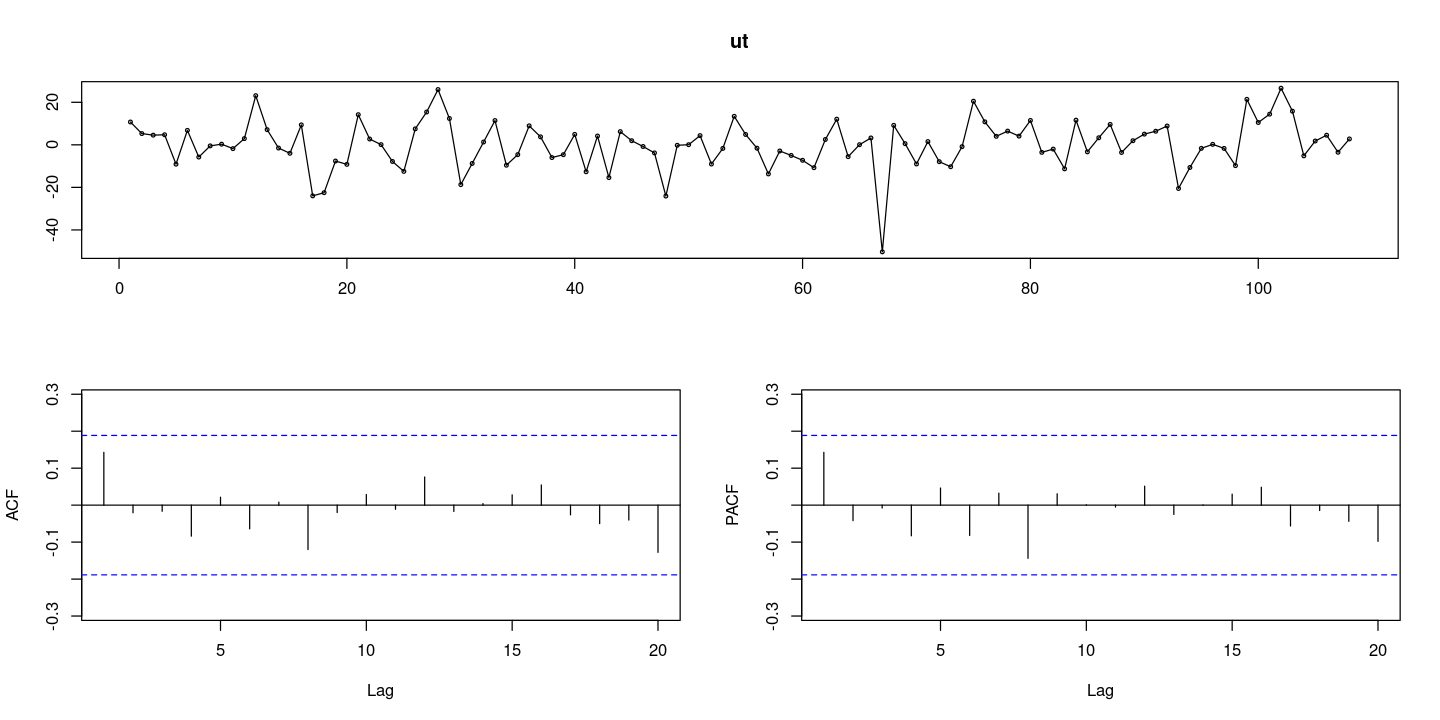

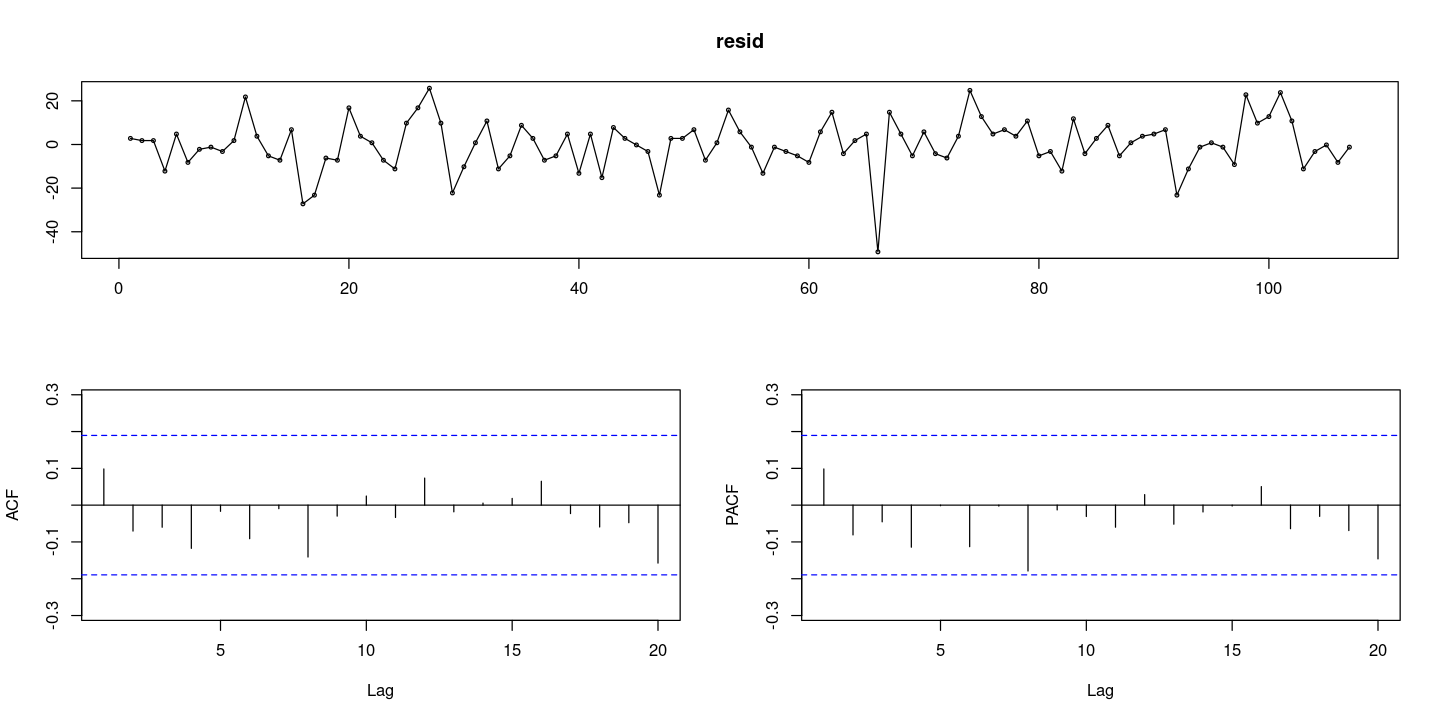

#### ut에 대한 잔차검정

ut <- resid(fit_et)

forecast::tsdisplay(ut)

- wn이다

## 정규성검정

tseries::jarque.bera.test(ut) ##JB test H0: normal

Jarque Bera Test

data: ut

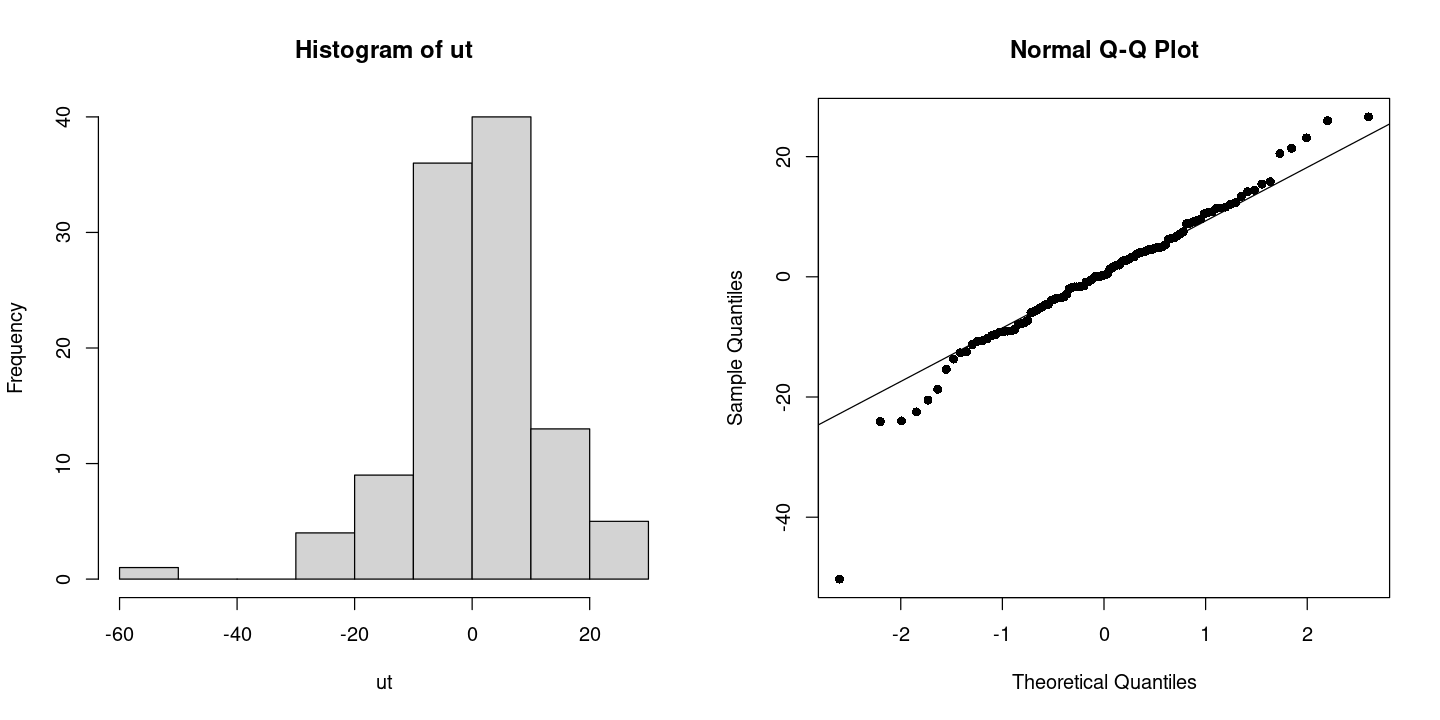

X-squared = 56.855, df = 2, p-value = 4.509e-13- 정규분포 아니다. (오차 작은거 하나 있어서)

par(mfrow=c(1,2))

hist(ut)

qqnorm(ut, pch=16)

qqline(ut)

# 잔차의 포트맨토 검정 ## H0 : rho1=...=rho_k=0

portes::LjungBox(fit_et, lags=c(6,12,18,24))| lags | statistic | df | p-value | |

|---|---|---|---|---|

| 6 | 3.677312 | 5 | 0.5967438 | |

| 12 | 6.277097 | 11 | 0.8542505 | |

| 18 | 7.217262 | 17 | 0.9805570 | |

| 24 | 13.987201 | 23 | 0.9272372 |

- 모든 차수에서 rho=0이다. WN이다.

## 잔차 검정

astsa::sarima(et, p=1, d=0, q=0)initial value 3.242671

iter 2 value 2.404146

iter 3 value 2.403718

iter 4 value 2.403704

iter 5 value 2.403697

iter 6 value 2.403671

iter 7 value 2.403663

iter 8 value 2.403662

iter 9 value 2.403646

iter 10 value 2.403646

iter 10 value 2.403646

iter 10 value 2.403646

final value 2.403646

converged

initial value 2.411035

iter 2 value 2.410970

iter 3 value 2.410428

iter 4 value 2.410411

iter 5 value 2.410401

iter 6 value 2.410390

iter 7 value 2.410390

iter 8 value 2.410389

iter 8 value 2.410389

iter 8 value 2.410389

final value 2.410389

converged$fit

Call:

arima(x = xdata, order = c(p, d, q), seasonal = list(order = c(P, D, Q), period = S),

xreg = xmean, include.mean = FALSE, transform.pars = trans, fixed = fixed,

optim.control = list(trace = trc, REPORT = 1, reltol = tol))

Coefficients:

ar1 xmean

0.9078 5.0964

s.e. 0.0400 10.8053

sigma^2 estimated as 122.1: log likelihood = -413.57, aic = 833.13

$degrees_of_freedom

[1] 106

$ttable

Estimate SE t.value p.value

ar1 0.9078 0.0400 22.6947 0.0000

xmean 5.0964 10.8053 0.4717 0.6381

$AIC

[1] 7.714211

$AICc

[1] 7.71527

$BIC

[1] 7.788715

결정적 추세가 아니라 확률적 추세라고 생각하고 차분을 진행하여 추세 성분 제거한 후 적합하기

## 차분

diff_z = diff(z)

forecast::tsdisplay(diff_z)

- 차분한 데이터가 WN이다.

Box.test(diff(z), lag=6, type = "Ljung-Box")

Box.test(diff(z), lag=12, type = "Ljung-Box")

Box-Ljung test

data: diff(z)

X-squared = 4.5688, df = 6, p-value = 0.6002

Box-Ljung test

data: diff(z)

X-squared = 7.895, df = 12, p-value = 0.7933t.test(diff(z))

One Sample t-test

data: diff(z)

t = 3.8382, df = 106, p-value = 0.0002111

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

2.037736 6.392171

sample estimates:

mean of x

4.214953 - 0은 좀 아닌거 같다..?

# Zt ~ radomwalk, ARIMA(0,1,0) with drift

## 모형 ARIMA(0,1,0)

fit <- arima(z,order=c(0,1,0))

summary(fit)

Call:

arima(x = z, order = c(0, 1, 0))

sigma^2 estimated as 145.6: log likelihood = -418.3, aic = 838.6

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set 4.177926 12.01043 9.085333 0.990671 2.414276 0.9909589 0.09736789fit2 <- arima(diff_z, order=c(0,0,0)) #알아서 mean을 적합해줌

summary(fit2)

Call:

arima(x = diff_z, order = c(0, 0, 0))

Coefficients:

intercept

4.215

s.e. 1.093

sigma^2 estimated as 127.8: log likelihood = -411.34, aic = 826.68

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set 2.091723e-15 11.30629 8.354441 -Inf Inf 0.7330884 0.09829173- 차분을 이용하여 적합한 최종 모형

- AIC가 더 작아졌다. drift가 있는 모형이 더 좋다

### 잔차검정

resid = resid(fit2)

forecast::tsdisplay(resid)

## 정규성검정

tseries::jarque.bera.test(resid) ##JB test H0: normal

Jarque Bera Test

data: resid

X-squared = 40.633, df = 2, p-value = 1.502e-09par(mfrow=c(1,2))

hist(resid)

qqnorm(resid)

qqline(resid)

# 잔차의 포트맨토 검정 ## H0 : rho1=...=rho_k=0

portes::LjungBox(fit_et, lags=c(6,12,18,24))| lags | statistic | df | p-value | |

|---|---|---|---|---|

| 6 | 3.677312 | 5 | 0.5967438 | |

| 12 | 6.277097 | 11 | 0.8542505 | |

| 18 | 7.217262 | 17 | 0.9805570 | |

| 24 | 13.987201 | 23 | 0.9272372 |

## 잔차 검정

astsa::sarima(z, p=0, d=1, q=0)initial value 2.425360

iter 1 value 2.425360

final value 2.425360

converged

initial value 2.425360

iter 1 value 2.425360

final value 2.425360

converged$fit

Call:

arima(x = xdata, order = c(p, d, q), seasonal = list(order = c(P, D, Q), period = S),

xreg = constant, transform.pars = trans, fixed = fixed, optim.control = list(trace = trc,

REPORT = 1, reltol = tol))

Coefficients:

constant

4.215

s.e. 1.093

sigma^2 estimated as 127.8: log likelihood = -411.34, aic = 826.68

$degrees_of_freedom

[1] 106

$ttable

Estimate SE t.value p.value

constant 4.215 1.093 3.8562 2e-04

$AIC

[1] 7.725979

$AICc

[1] 7.726336

$BIC

[1] 7.775939

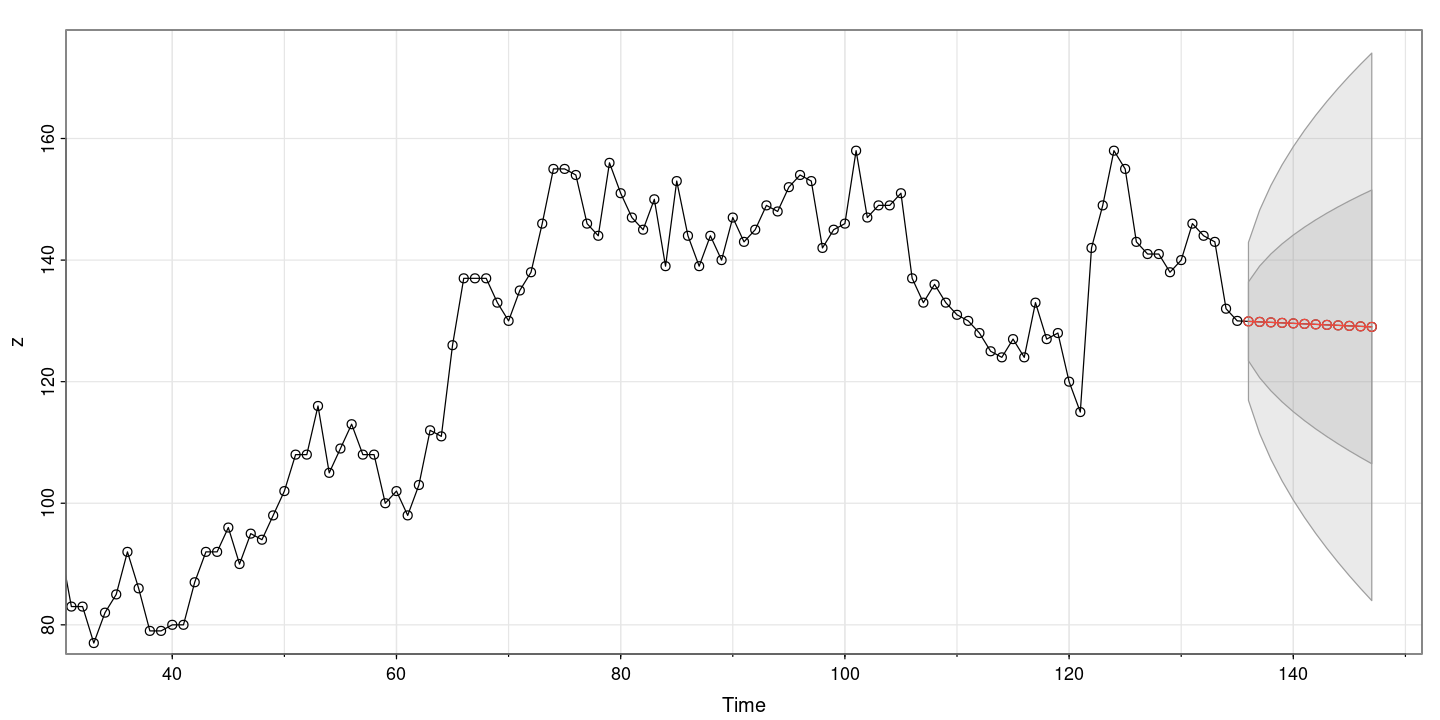

astsa::sarima.for(z, n.ahead=12, p=0, d=1, q=0)- $pred

- A Time Series:

- 671.21495327103

- 675.429906542061

- 679.644859813091

- 683.859813084122

- 688.074766355152

- 692.289719626183

- 696.504672897213

- 700.719626168244

- 704.934579439274

- 709.149532710305

- 713.364485981335

- 717.579439252366

- $se

- A Time Series:

- 11.306294696503

- 15.9895152999816

- 19.5830768596898

- 22.612589393006

- 25.2816435150261

- 27.694652887968

- 29.9136440165555

- 31.9790305999631

- 33.918884089509

- 35.7536431380317

- 37.4987372774857

- 39.1661537193795